JPMorgan Chase & Co (JPM)

307.87

-3.03 (-0.97%)

NYSE · Last Trade: Jan 14th, 6:53 PM EST

Detailed Quote

| Previous Close | 310.90 |

|---|---|

| Open | 308.20 |

| Bid | 307.45 |

| Ask | 307.60 |

| Day's Range | 306.12 - 311.76 |

| 52 Week Range | 202.16 - 337.25 |

| Volume | 25,943,640 |

| Market Cap | 948.98B |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 6.000 (1.95%) |

| 1 Month Average Volume | 10,554,497 |

Chart

About JPMorgan Chase & Co (JPM)

JPMorgan Chase & Co. is a leading global financial services firm that provides a wide range of financial solutions to consumers, businesses, and governments. The company offers investment banking, asset management, private banking, and wealth management services while also delivering a full suite of commercial banking products. With a strong emphasis on innovation and technology, JPMorgan Chase plays a pivotal role in the financial market, helping clients navigate complex financial landscapes through expert advice and tailored services. The firm is committed to maintaining its reputation for integrity and professionalism while actively contributing to economic development and community investment. Read More

News & Press Releases

On Jan. 14, 2026, investors reassessed a major bank's record quarter against cautious 2026 income guidance and sector-wide pressure.

Via The Motley Fool · January 14, 2026

Shares of mortgage insurance provider Essent Group (NYSE:ESNT) jumped 3.4% in the afternoon session after JPMorgan Chase & Co. raised its price target on the stock from $65.00 to $66.00.

Via StockStory · January 14, 2026

Troy Rohrbaugh, Co-CEO of the Commercial & Investment Bank, will present at the UBS Financial Services Conference in Key Biscayne, Florida on Tuesday, February 10, 2026 at 9:40 a.m. (Eastern).

By JPMorgan Chase & Co. · Via Business Wire · January 14, 2026

As the calendar turns to January 14, 2026, the Federal Reserve finds itself at a critical juncture in its multi-year campaign to stabilize the American economy. After a series of calibrated adjustments throughout late 2025, the federal funds rate currently sits at a consensus target of 3.50%–3.75%

Via MarketMinute · January 14, 2026

In a historic milestone for the financial sector, Goldman Sachs (NYSE: GS) has surged to an all-time high, with shares crossing the $920 threshold during mid-January 2026 trading. This rally, which has seen the stock climb nearly 60% over the past twelve months, marks a triumphant validation of CEO David

Via MarketMinute · January 14, 2026

As the first quarter of 2026 unfolds, a striking divergence has emerged within the American equity markets. While the broader S&P 500 has faced a wave of downward earnings revisions amidst cooling consumer demand and persistent labor costs, the financial sector has remarkably bucked the trend. Analysts have raised

Via MarketMinute · January 14, 2026

As the first two weeks of 2026 draw to a close, the financial markets have found an unlikely hero in the form of the benchmark 10-year Treasury yield. Holding steady at approximately 4.15%, the yield has provided a "Goldilocks" environment—neither too hot to trigger valuation fears nor too

Via MarketMinute · January 14, 2026

The U.S. economy appears to be defying gravity as it enters the new year. On January 9, 2026, the Federal Reserve Bank of Atlanta’s GDPNow model sent shockwaves through the financial markets by forecasting a real GDP growth rate of 5.1% for the fourth quarter of 2025.

Via MarketMinute · January 14, 2026

Shares of biopharma manufacturing company Repligen Corporation (NASDAQ:RGEN)

fell 3.9% in the afternoon session after the company presented at the JPMorgan Healthcare Conference and shared its sales guidance for 2025.

Via StockStory · January 14, 2026

Shares of healthcare staffing company AMN Healthcare Services (NYSE:AMN)

jumped 17.2% in the afternoon session after the company presented at the J.P. Morgan Healthcare Conference, where it outlined a positive outlook and strategic growth plans.

Via StockStory · January 14, 2026

The financial markets experienced a significant downturn on January 14, 2026, as investors grappled with a dense "data dump" following a 43-day federal government shutdown. The simultaneous release of the November 2025 Producer Price Index (PPI) and Retail Sales reports painted a picture of an economy that is simultaneously "too

Via MarketMinute · January 14, 2026

The United States labor market hit a significant speed bump in the final month of 2025, sending ripples of uncertainty through Wall Street and the hallowed halls of the Federal Reserve. According to the latest data released by the Bureau of Labor Statistics, nonfarm payrolls increased by a meager 50,

Via MarketMinute · January 14, 2026

The S&P 500 has kicked off 2026 with a powerful display of momentum, climbing 1.9% in the first two weeks of the year to reach historic levels. Following a robust 16.4% gain in 2025, the index hit a record closing high of 6,977.32 on January

Via MarketMinute · January 14, 2026

As the financial markets recalibrate for the 2026 fiscal year, the narrative of the banking sector is dominated by a return to traditional profitability models and a strategic shift in power. On January 14, 2026, the release of fourth-quarter earnings from the nation’s largest lenders has confirmed what many

Via MarketMinute · January 14, 2026

In a landmark financial result that signals the most significant turning point in its decade-long turnaround, Citigroup (NYSE: C) reported fourth-quarter 2025 earnings today that blew past even the most optimistic Wall Street forecasts. While analysts had entered the quarter expecting a sector-leading 21% year-on-year growth, the bank delivered a

Via MarketMinute · January 14, 2026

As the first major financial institution to pull back the curtain on its final performance for 2025, JPMorgan Chase & Co. (NYSE: JPM) has officially kicked off the 2026 earnings season with a report that signals both resilience and transition. On January 13, 2026, the banking giant posted adjusted earnings that

Via MarketMinute · January 14, 2026

For many investors, it's the best large bank in this country.

Via The Motley Fool · January 14, 2026

In a week defined by economic cross-currents, the 10-year U.S. Treasury yield has retreated to 4.16%, a significant pivot from the 4.21% highs seen late last year. This downward shift comes as investors digest a complex cocktail of data: a surprisingly robust holiday shopping season juxtaposed against

Via MarketMinute · January 14, 2026

As the financial world settles into the first weeks of 2026, Oppenheimer Asset Management has sent a jolt through the markets by issuing a "Street-high" price target for the S&P 500, projecting the index will reach 8,100 by the end of the year. This aggressive forecast suggests a

Via MarketMinute · January 14, 2026

JPMorgan's Q4 earnings beat expectations on expense management, prompting Goldman Sachs to reaffirm Buy and $386 price target amid shares trading lower.

Via Benzinga · January 14, 2026

The U.S. banking sector is facing its most significant regulatory upheaval in decades as a bipartisan push to cap credit card interest rates at 10% gains sudden, aggressive momentum in Washington. This week, the stock market responded with a sharp sell-off, as investors priced in a future where the

Via MarketMinute · January 14, 2026

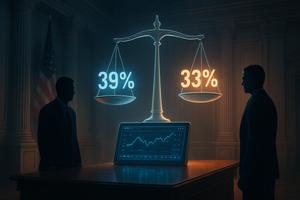

The transition of power at the Federal Reserve has officially moved from a matter of speculation to a high-stakes duel in the prediction markets. As of January 14, 2026, the race to succeed Jerome Powell as Chair of the Federal Reserve has seen a dramatic shift in momentum. For months, the market had favored a [...]

Via PredictStreet · January 14, 2026

The American financial landscape was thrust into uncharted territory this week following the startling revelation that the Department of Justice has launched a formal investigation into Federal Reserve Chair Jerome Powell. The probe, which Powell himself disclosed in an unprecedented video address on Sunday, January 11, 2026, marks the most

Via MarketMinute · January 14, 2026

In a move that has sent shockwaves through the financial services sector, shares of payment processing titans Visa and Mastercard plummeted on Tuesday following a surprise endorsement from President Donald Trump for the Credit Card Competition Act (CCCA). The legislative push, which aims to dismantle what critics call a "duopoly"

Via MarketMinute · January 14, 2026

The American consumer remains the bedrock of the economy, as evidenced by a surprise jump in November retail sales data released today, January 14, 2026. Despite a backdrop of political uncertainty and a 43-day federal government shutdown that delayed the reporting cycle, the figures revealed a robust appetite for spending.

Via MarketMinute · January 14, 2026