Morgan Stanley (MS)

180.80

-1.96 (-1.08%)

NYSE · Last Trade: Jan 14th, 3:23 PM EST

Detailed Quote

| Previous Close | 182.76 |

|---|---|

| Open | 182.19 |

| Bid | 180.80 |

| Ask | 180.83 |

| Day's Range | 178.93 - 182.35 |

| 52 Week Range | 94.33 - 188.82 |

| Volume | 5,296,414 |

| Market Cap | 329.87B |

| PE Ratio (TTM) | 18.54 |

| EPS (TTM) | 9.8 |

| Dividend & Yield | 4.000 (2.21%) |

| 1 Month Average Volume | 4,847,374 |

Chart

About Morgan Stanley (MS)

Morgan Stanley is a leading global financial services firm that provides a wide range of services in investment banking, securities, wealth management, and investment management. Catering to a diverse clientele that includes corporations, governments, and individuals, Morgan Stanley offers expert advisory and financing services, helping clients navigate complex financial markets and achieve their financial objectives. The firm is known for its strategic insights, innovative solutions, and commitment to delivering exceptional service, positioning itself as a trusted partner in the world of finance. Read More

News & Press Releases

As of mid-January 2026, the global semiconductor industry finds itself at a dizzying crossroads. Micron Technology (NASDAQ: MU) has just closed a year that defied even the most optimistic projections, fueled by a relentless "AI Memory Supercycle" that has sent its stock price soaring toward the $400 mark. Yet, despite

Via MarketMinute · January 14, 2026

In a historic milestone for the financial sector, Goldman Sachs (NYSE: GS) has surged to an all-time high, with shares crossing the $920 threshold during mid-January 2026 trading. This rally, which has seen the stock climb nearly 60% over the past twelve months, marks a triumphant validation of CEO David

Via MarketMinute · January 14, 2026

As the first quarter of 2026 unfolds, a striking divergence has emerged within the American equity markets. While the broader S&P 500 has faced a wave of downward earnings revisions amidst cooling consumer demand and persistent labor costs, the financial sector has remarkably bucked the trend. Analysts have raised

Via MarketMinute · January 14, 2026

As the first two weeks of 2026 draw to a close, the financial markets have found an unlikely hero in the form of the benchmark 10-year Treasury yield. Holding steady at approximately 4.15%, the yield has provided a "Goldilocks" environment—neither too hot to trigger valuation fears nor too

Via MarketMinute · January 14, 2026

The S&P 500 has kicked off 2026 with a powerful display of momentum, climbing 1.9% in the first two weeks of the year to reach historic levels. Following a robust 16.4% gain in 2025, the index hit a record closing high of 6,977.32 on January

Via MarketMinute · January 14, 2026

As the sun rises on 2026, the frozen tundra of the global capital markets has finally given way to a roaring spring. Following two years of stagnation characterized by "wait-and-see" attitudes and high-interest-rate anxiety, the financial world is witnessing a dramatic resurgence. At the heart of this revival are the

Via MarketMinute · January 14, 2026

As the first major financial institution to pull back the curtain on its final performance for 2025, JPMorgan Chase & Co. (NYSE: JPM) has officially kicked off the 2026 earnings season with a report that signals both resilience and transition. On January 13, 2026, the banking giant posted adjusted earnings that

Via MarketMinute · January 14, 2026

In a week defined by economic cross-currents, the 10-year U.S. Treasury yield has retreated to 4.16%, a significant pivot from the 4.21% highs seen late last year. This downward shift comes as investors digest a complex cocktail of data: a surprisingly robust holiday shopping season juxtaposed against

Via MarketMinute · January 14, 2026

As the financial world settles into the first weeks of 2026, Oppenheimer Asset Management has sent a jolt through the markets by issuing a "Street-high" price target for the S&P 500, projecting the index will reach 8,100 by the end of the year. This aggressive forecast suggests a

Via MarketMinute · January 14, 2026

The U.S. banking sector is facing its most significant regulatory upheaval in decades as a bipartisan push to cap credit card interest rates at 10% gains sudden, aggressive momentum in Washington. This week, the stock market responded with a sharp sell-off, as investors priced in a future where the

Via MarketMinute · January 14, 2026

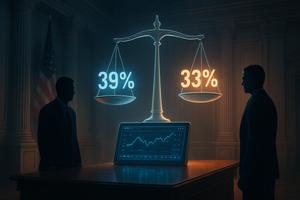

The transition of power at the Federal Reserve has officially moved from a matter of speculation to a high-stakes duel in the prediction markets. As of January 14, 2026, the race to succeed Jerome Powell as Chair of the Federal Reserve has seen a dramatic shift in momentum. For months, the market had favored a [...]

Via PredictStreet · January 14, 2026

Today’s date is January 14, 2026. As the fourth-quarter earnings season kicks into high gear, all eyes are on the giants of the financial district. Among the "Bulge Bracket," perhaps no firm enters this reporting cycle with as much momentum and scrutiny as Morgan Stanley (NYSE: MS). Long viewed as the barometer for global capital [...]

Via Finterra · January 14, 2026

Date: January 14, 2026 As the global financial markets settle into the first weeks of 2026, all eyes are turned toward 200 West Street. Tomorrow, The Goldman Sachs Group, Inc. (NYSE: GS) will release its fourth-quarter and full-year 2025 results. For a firm that spent much of the early 2020s navigating a painful strategic identity [...]

Via Finterra · January 14, 2026

Wednesday's earnings reports from some major banks are just the appetizer. On Thursday, the main course will be served up by Morgan Stanley, Goldman Sachs, PNC, and U.S. Bancorp.

Via Barchart.com · January 14, 2026

The "lithium winter" that chilled the clean energy sector for nearly two years has officially thawed. As of mid-January 2026, the lithium market is signaling a decisive V-shaped recovery, marked by a dramatic rebound in prices and a shift from a global surplus to a looming structural deficit. The catalyst

Via MarketMinute · January 14, 2026

As Wall Street moves into the heart of the January earnings season, all eyes have turned toward Morgan Stanley (NYSE: MS), which is scheduled to report its fourth-quarter 2025 results on Thursday, January 15, 2026. Following a year of tentative recovery, the financial sector is now witnessing what many are

Via MarketMinute · January 14, 2026

As of today, January 14, 2026, International Business Machines Corp. (NYSE: IBM) has officially set the stage for its upcoming fourth-quarter and full-year 2025 financial results call. This announcement comes at a pivotal moment for the technology titan, which has spent the last year solidifying its reputation as the enterprise standard for hybrid cloud and [...]

Via Finterra · January 14, 2026

Date: January 14, 2026 Introduction As the sun rises over the Manhattan skyline on this crisp winter morning, the financial world is fixed on 270 Park Avenue. JPMorgan Chase & Co. (NYSE: JPM), the undisputed titan of global finance, has just released its fourth-quarter and full-year 2025 earnings. In an era defined by rapid technological [...]

Via Finterra · January 14, 2026

In a complex start to the 2026 banking earnings season, JPMorgan Chase & Co. (NYSE: JPM) reported fourth-quarter results that surpassed headline profit expectations but left investors uneasy. Despite delivering an adjusted earnings per share (EPS) of $5.23—well above the $4.95 consensus estimate—the banking giant's shares tumbled

Via MarketMinute · January 14, 2026

For nearly a decade, Wells Fargo & Company (NYSE: WFC) stood as the cautionary tale of American banking—a once-venerated institution crippled by self-inflicted scandals and unprecedented regulatory constraints. However, as of January 14, 2026, the narrative surrounding the San Francisco-based giant has fundamentally shifted. No longer defined solely by its past "fake accounts" legacy, Wells [...]

Via Finterra · January 14, 2026

As of early 2026, Citigroup Inc. (NYSE: C) stands at a historic crossroads. Long considered the "problem child" of the American "Big Four" banks—a global behemoth bogged down by complexity, regulatory hurdles, and chronic underperformance—the institution is finally emerging from a radical, multi-year metamorphosis. Under the leadership of CEO Jane Fraser, the bank has executed [...]

Via Finterra · January 14, 2026

As of January 14, 2026, the semiconductor industry has reached a "Great Decoupling," shifting from a CPU-centric world to one dominated by massive AI infrastructure. At the heart of this transformation is Advanced Micro Devices, Inc. (Nasdaq: AMD), a company that has spent the last decade executing one of the most significant turnarounds in corporate [...]

Via Finterra · January 14, 2026

Today’s Date: January 14, 2026 Introduction In the world of global finance, few institutions command the same gravity as JPMorgan Chase & Co. (NYSE: JPM). As of January 2026, the firm stands not just as the largest bank in the United States, but as a "fortress" that has navigated a decade of radical economic shifts—from [...]

Via Finterra · January 14, 2026

Bank of America, Wells Fargo, Citi report on busy day 2 of bank earnings. Shares slide on mixed results.

Via Investor's Business Daily · January 14, 2026

Several Wall Street analysts have upwardly revised their earnings estimates and target prices on Palantir.

Via The Motley Fool · January 14, 2026