Transocean Ltd (RIG)

4.3800

+0.0900 (2.10%)

NYSE · Last Trade: Jan 14th, 9:47 PM EST

MELBOURNE, Australia — As the curtain closes on 2025, Transocean Ltd. (NYSE:RIG) has solidified its position as the undisputed titan of the offshore drilling world, propelled by a highly successful and strategically vital drilling campaign in Australian waters. The company’s stock, which faced significant headwinds earlier in the decade,

Via MarketMinute · December 31, 2025

Transocean (RIG) Q1 2025 Earnings Call Transcript

Via The Motley Fool · December 23, 2025

Transocean (RIG) Q3 2025 Earnings Call Transcript

Via The Motley Fool · December 23, 2025

Transocean Stock Drops After Announcing Upsized Share Offering At A Discountstocktwits.com

Via Stocktwits · September 25, 2025

Why Did Transocean Stock Fall Over 12% After-Hours Today?stocktwits.com

Via Stocktwits · September 24, 2025

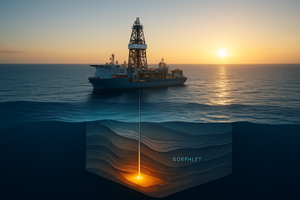

In a landmark announcement on December 22, 2025, energy giants Shell and INEOS Energy revealed a significant oil discovery at the Nashville exploration well, situated in the deepwater Norphlet play of the U.S. Gulf of Mexico—a region now increasingly referred to by industry and government officials as the

Via MarketMinute · December 22, 2025

Offshore drilling specialist Transocean reported a notable insider sale amid ongoing industry volatility and a year of modest share gains.

Via The Motley Fool · December 19, 2025

Royal Dutch Shell (NYSE: SHEL) is making aggressive strategic moves to expand its deepwater operations in the US Gulf of Mexico, signaling a firm long-term commitment to the region despite the inherent volatility of global oil and gas prices. These expansions, characterized by significant investments in new projects and strategic

Via MarketMinute · December 9, 2025

Transocean Executive Vice President and Chief Commercial Officer Roderick Mackenzie sold another tranche of shares in late October. Should investors follow suit?

Via The Motley Fool · December 9, 2025

Ninepoint took a new position in offshore drilling company, Transocean, worth $18.7 million.

Via The Motley Fool · November 25, 2025

The global oil market is experiencing a significant revival, a trend profoundly impacting key players within the energy sector. Leading this charge in the offshore drilling segment is Transocean (NYSE: RIG), whose recent strategic financial maneuvers and burgeoning contract backlog have ignited an "upward volatile swing" in its stock performance.

Via MarketMinute · October 22, 2025

October 16, 2025 – The United States oil industry is witnessing a significant pivot, with deepwater drilling in the Gulf of Mexico (GoM) emerging as the primary engine for growth, even as onshore shale production faces an anticipated slowdown. This strategic shift marks a renewed era for offshore exploration and production,

Via MarketMinute · October 16, 2025

Transocean’s stock offering and insider buy hint at a turnaround. See why RIG stock could surge 70%+ as oil rebounds and debt shrinks.

Via MarketBeat · October 8, 2025

Benzinga examined the prospects for many investors' favorite stocks over the last week — here's a look at some of our top stories.

Via Benzinga · September 27, 2025

Let's dive into the action on the US markets on Thursday. Here are the most active stocks that are driving the market today.

Via Chartmill · September 25, 2025

The US market is yet to commence its session on Thursday, but let's get a preview of the pre-market session and explore the top gainers and losers driving the early market movements.

Via Chartmill · September 25, 2025

U.S. stock futures were mixed this morning, with the Dow futures gaining around 0.1% on Thursday. Shares of Stitch Fix, Inc. (NASDAQ: SFIX) dipped 7.6% to $5.21 in pre-market trading following the release of fourth-quarter results.

Via Benzinga · September 25, 2025

Shares of PepGen Inc. (NASDAQ: PEPG) rose sharply in pre-market trading after the company announced the launch of an underwritten public offering of common stock and pre-funded warrants.

Via Benzinga · September 25, 2025

After the closing bell on Wednesday, let's take a glimpse of the US markets and explore the top gainers and losers in today's after-hours session.

Via Chartmill · September 24, 2025

Transocean shares are tumbling in Wednesday's after-hours session after the company announced a public offering.

Via Benzinga · September 24, 2025

Via Benzinga · September 23, 2025

As interest rates get cut, new business activity could boost oil demand moving forward, where these three stocks could deliver outsized returns for investors.

Via MarketBeat · September 23, 2025

Positioning in the oil markets show a potential for a "pain trade" where a squeeze in supply could come about, spiking oil prices much higher

Via MarketBeat · September 11, 2025