Newmont Mining (NEM)

114.15

-0.48 (-0.42%)

NYSE · Last Trade: Jan 15th, 2:52 AM EST

In a historic trading session that has sent shockwaves through global financial centers, gold and silver have both shattered all-time records today, January 14, 2026. Spot gold surged past the $4,630 per ounce mark, while silver took a violent leap to over $90 per ounce, marking a staggering 27%

Via MarketMinute · January 14, 2026

In a historic session for the precious metals sector, Newmont Corporation (NYSE: NEM) surged to an all-time high of $106.38 on Wednesday, Jan. 14, 2026. The world's largest gold producer is now the primary beneficiary of a relentless "super-cycle" that has propelled spot gold prices to a staggering $4,

Via MarketMinute · January 14, 2026

The global financial landscape was rocked this week as gold prices surged to an unprecedented $4,600.33 per ounce, a historic milestone driven by an escalating and unprecedented confrontation between the Trump administration and the Federal Reserve. The sudden spike reflects a deepening sense of panic among global investors

Via MarketMinute · January 14, 2026

The global metals market reached a historic milestone on January 13, 2026, as silver futures settled at a staggering $85.877 per ounce. This monumental surge marks a definitive transition for silver, moving it from a speculative precious metal to a critical industrial-monetary hybrid asset. The rally is not an

Via MarketMinute · January 13, 2026

As of January 13, 2026, the global financial landscape has been fundamentally reshaped by a precious metal that refuses to yield. Gold prices are currently holding steady near a staggering record high of $4,600 per ounce, a milestone that just two years ago seemed like a distant peak. This

Via MarketMinute · January 13, 2026

As of January 13, 2026, the global financial landscape is grappling with a series of high-stakes trade maneuvers from the Trump administration that have fundamentally altered investor sentiment. Following a flurry of announcements over the last 72 hours, including a massive 25% global tariff on any nation trading with Iran

Via MarketMinute · January 13, 2026

The global economy is entering a period of "tepid resilience," according to the World Bank’s January 2026 Global Economic Prospects report released today. The report projects that global GDP growth will stabilize at 2.6% in 2026, a slight upward revision from previous estimates that nonetheless underscores a decade

Via MarketMinute · January 13, 2026

As of January 13, 2026, the global financial landscape has been fundamentally reshaped by a historic surge in precious metals. Gold has shattered expectations, climbing to an unprecedented $4,630 per ounce, while silver has staged a parabolic run to reach $84 per ounce. This dual rally, which began in

Via MarketMinute · January 13, 2026

As of January 13, 2026, the global financial landscape is witnessing a historic structural repricing of precious metals. Gold has shattered expectations, surging past the $4,600 per ounce mark, while silver has accelerated into "price discovery" territory, trading north of $85 per ounce. This vertical ascent has finally ignited

Via MarketMinute · January 13, 2026

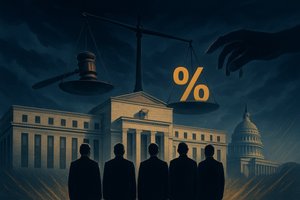

The global financial landscape has been thrust into a state of profound uncertainty as a Department of Justice (DOJ) investigation into Federal Reserve Chair Jerome Powell escalates, threatening the long-standing independence of the U.S. central bank. As of January 13, 2026, the bullion market has emerged as the primary

Via MarketMinute · January 13, 2026

The global financial landscape has been thrust into a state of extreme turbulence as of January 13, 2026, with precious metals prices skyrocketing in response to a dramatic escalation in U.S.-Iran tensions. Following a series of aggressive policy shifts from the White House, gold has shattered long-standing psychological

Via MarketMinute · January 13, 2026

In an extraordinary display of market momentum, gold and silver prices surged to unprecedented heights this week, shattering previous records and fundamentally altering the landscape for global commodities. On January 12, 2026, spot gold prices broke through the psychological $4,600 per ounce barrier for the first time in history,

Via MarketMinute · January 13, 2026

WASHINGTON D.C. — The global financial order was pushed to the brink this morning, January 12, 2026, as the U.S. dollar plummeted following an unprecedented legal assault by the Department of Justice against the Federal Reserve. The greenback, already weakened by a year of fiscal uncertainty, fell sharply in

Via MarketMinute · January 12, 2026

Gold prices surged to an unprecedented all-time high on Monday, January 12, 2026, as a deepening conflict between the White House and the Federal Reserve sent shockwaves through global financial markets. Spot gold breached the $4,600 mark for the first time in history, peaking at $4,600.33 per

Via MarketMinute · January 12, 2026

The long-standing tension between the executive branch and the nation’s central bank reached a boiling point this week as the U.S. Department of Justice (DOJ) launched a formal criminal investigation into Federal Reserve Chair Jerome Powell. The probe, which centers on allegations of perjury regarding a multi-billion dollar

Via MarketMinute · January 12, 2026

Newmont Corp (NYSE:NEM) shares are trading higher on Monday as precious‑metals prices jump, driven by a sharp move into safe‑haven assets

Via Benzinga · January 12, 2026

As of January 12, 2026, the traditional boundaries between the U.S. executive branch and the Federal Reserve have effectively dissolved, sparking a historic standoff that has left investors grappling with the future of American monetary independence. Following a dramatic Sunday evening video statement from Fed Chair Jerome Powell, in

Via MarketMinute · January 12, 2026

The US Dollar plummeted in early trading on January 12, 2026, as global investors reacted with alarm to the news that the Department of Justice (DOJ) has launched a formal criminal inquiry into the Federal Reserve. The US Dollar Index (DXY), which tracks the greenback against a basket of major

Via MarketMinute · January 12, 2026

WASHINGTON, D.C. — In a historic display of institutional solidarity, a bipartisan coalition of former Federal Reserve leaders and Treasury officials issued a blistering rebuke today, January 12, 2026, against the Department of Justice’s (DOJ) criminal investigation into sitting Fed Chair Jerome Powell. The joint statement, signed by former

Via MarketMinute · January 12, 2026

The bedrock of global financial stability was shaken on Monday, January 12, 2026, as U.S. Treasury yields surged in response to an unprecedented Department of Justice (DOJ) investigation into the Federal Reserve. The benchmark 10-year Treasury yield climbed to 4.20%, reflecting a sudden and sharp "political risk premium"

Via MarketMinute · January 12, 2026

WASHINGTON D.C. / NEW YORK — In a historic convergence of political turmoil and financial upheaval, gold and silver prices have surged to unprecedented all-time highs as of January 12, 2026. The rally comes as investors scramble for safe-haven assets following the Department of Justice's escalation of a criminal investigation into

Via MarketMinute · January 12, 2026

Top S&P500 movers in Monday's sessionchartmill.com

Via Chartmill · January 12, 2026

The long-simmering tension between the executive branch and the Federal Reserve reached a boiling point this week as Fed Chair Jerome Powell publicly condemned a Department of Justice (DOJ) subpoena as a political weapon. In an unprecedented move on Sunday, January 11, 2026, Powell released a video statement labeling the

Via MarketMinute · January 12, 2026

In a move that has sent shockwaves through global financial centers and ignited a constitutional firestorm, the Department of Justice (DOJ) has officially opened a criminal investigation into Federal Reserve Chair Jerome Powell. The probe, which centers on allegations of "lying to Congress" regarding a multibillion-dollar renovation of the Federal

Via MarketMinute · January 12, 2026

The U.S. Treasury market was plunged into a state of historic volatility on Monday, January 12, 2026, as investors reacted to an unprecedented legal assault on the Federal Reserve’s independence. Following a defiant Sunday evening statement by Fed Chair Jerome Powell, in which he revealed that the Department

Via MarketMinute · January 12, 2026