Caterpillar (CAT)

694.81

-5.88 (-0.84%)

NYSE · Last Trade: Mar 13th, 10:51 AM EDT

The Federal Reserve’s latest “Beige Book” summary, released on March 4, 2026, has sent a ripple of caution through the financial markets, painting a stark picture of an American economy split down the middle. While some sectors are riding the wave of a massive artificial intelligence infrastructure boom, the

Via MarketMinute · March 13, 2026

NEW YORK — The global bond market is currently locked in a high-stakes standoff as the 10-year Treasury Note experiences its most volatile month in years. As of March 13, 2026, investors are navigating a treacherous economic landscape where the inflationary pressures of a widening Middle East conflict are colliding head-on

Via MarketMinute · March 13, 2026

Via Talk Markets · March 12, 2026

In a dramatic reversal of the multi-year technology bull run, the global equity markets have entered what analysts are calling the "Great Rotation of 2026." As of March 13, 2026, capital is aggressively exiting the once-bulletproof AI software sector, flowing instead into "physical asset" industries like energy, utilities, and industrial

Via MarketMinute · March 13, 2026

The American manufacturing sector remains mired in a stubborn downturn, as the Institute for Supply Management (ISM) reported today that its Manufacturing Purchasing Managers' Index (PMI) remained in contraction territory for the 12th consecutive month. The February reading of 48.2%—released in early March 2026—underscores a persistent slump

Via MarketMinute · March 13, 2026

As the global energy markets witness a historic "March 2026 Energy Rally," one company has emerged at the center of a radical industrial convergence. Atlas Energy Solutions Inc. (NYSE: AESI) is no longer merely the king of West Texas sand. In a week defined by surging power demand and grid instability, Atlas has captured the [...]

Via Finterra · March 13, 2026

As of March 12, 2026, the U.S. stock market is undergoing its most profound structural realignment in a decade. The "Great Rotation"—a massive migration of capital away from the high-flying technology giants that defined the post-pandemic era and toward the foundational "Old Economy" sectors—has reached a fever

Via MarketMinute · March 12, 2026

What Happened? Shares of proppant sand producer Atlas Energy Solutions (NYSE:AESI) jumped 2.7% in the afternoon session after the stock's positive momentum c...

Via StockStory · March 12, 2026

As the curtains draw on China’s 2026 "Two Sessions"—the annual concurrent meetings of the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC)—the global financial landscape is grappling with a profound structural shift. Beijing has formally moved away from the era of

Via MarketMinute · March 12, 2026

As of March 12, 2026, the financial landscape has undergone a seismic shift that few predicted with such velocity: the long-awaited "Great Rotation." After three years of dominance by artificial intelligence and mega-cap technology firms, capital is aggressively flowing out of Silicon Valley and into the "Real Economy"—specifically the

Via MarketMinute · March 12, 2026

The S&P 500 has officially triggered a "mini death cross," a bearish technical signal where the 20-day moving average crosses below the 50-day moving average, signaling a sharp deterioration in market momentum. This development, occurring in early March 2026, has sent ripples through Wall Street as the index struggles

Via MarketMinute · March 12, 2026

The U.S. labor market sent shockwaves through global financial centers following the release of the February 2026 employment report, which revealed a staggering net loss of 92,000 jobs. This figure stood in stark contrast to economist expectations of a 70,000-job gain, marking the sharpest divergence from consensus

Via MarketMinute · March 12, 2026

Check out the companies making headlines yesterday: Saia (NASDAQ:SAIA): Freight transportation and logistics provider Saia (NASDAQ:SAIA) fell by 4.3% on Wedn...

Via StockStory · March 12, 2026

Via Benzinga · March 11, 2026

The global trade landscape was thrown into a state of high-stakes volatility this quarter as President Trump issued a stark ultimatum to America’s closest European allies: enter negotiations for the sale of Greenland or face a devastating "Greenland Surcharge" on all exports to the United States. The proposal, which

Via MarketMinute · March 11, 2026

What Happened? Shares of proppant sand producer Atlas Energy Solutions (NYSE:AESI) jumped 3.8% in the afternoon session after the company announced it entere...

Via StockStory · March 11, 2026

The ghost of the 1970s has returned to haunt Wall Street. As of March 11, 2026, the primary narrative dominating financial markets is no longer a "soft landing" or a "no landing," but the far more treacherous specter of stagflation. A toxic combination of a hotter-than-expected January Producer Price Index

Via MarketMinute · March 11, 2026

NEW YORK — As the smoke clears over the Persian Gulf following the largest military escalation in the region in decades, a fundamental shift is occurring on Wall Street. The "HALO Trade"—an acronym for Heavy Assets, Low Obsolescence—has rapidly replaced the AI-driven "Growth at Any Price" mantra of the

Via MarketMinute · March 11, 2026

As the global financial landscape shifts into a new era of commodity-driven dominance, Newmont Corp (NYSE: NEM) has officially ushered in what analysts are calling the "Golden Age" of profitability. Reporting its first-quarter results for 2026, the Denver-based mining giant stunned Wall Street with an earnings beat of 72 cents

Via MarketMinute · March 11, 2026

Data from Stocktwits indicated that retail sentiment on SPY and QQQ reflects growing caution in the market.

Via Stocktwits · March 11, 2026

While strong cash flow is a key indicator of stability, it doesn’t always translate to superior returns. Some cash-heavy businesses struggle with inefficient...

Via StockStory · March 11, 2026

On Tuesday, March 10, 2026, the industrial sector demonstrated a remarkable display of resilience and strength, with the Industrials Select Sector SPDR Fund (NYSE Arca: XLI) rising 0.6% even as the broader tech-heavy indices faced continued volatility. This modest but significant gain underscores a fundamental shift in market leadership

Via MarketMinute · March 10, 2026

In a trading session defined by whiplash-inducing volatility, the Dow Jones Industrial Average (DJIA) successfully navigated a massive 1,125-point intraday swing on March 10, 2026, to close at 47,740.80. The 0.5% gain may appear modest on paper, but the technical implications are profound, as the blue-chip

Via MarketMinute · March 10, 2026

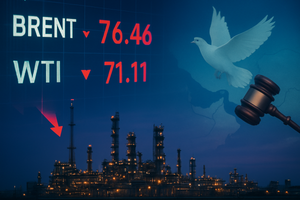

NEW YORK — Global energy markets experienced a seismic shift this week as crude oil prices plummeted from their recent geopolitical highs, providing a much-needed reprieve for a global economy that had been teetering on the edge of an energy-induced recession. Brent crude, the international benchmark, fell sharply below the psychologically

Via MarketMinute · March 10, 2026

The February 2026 ADP National Employment Report has sent a clear signal of stability to Wall Street, revealing that private sector employers added 63,000 jobs during the month. This figure comfortably surpassed the consensus analyst estimate of 50,000, suggesting that despite persistent high interest rates and global economic

Via MarketMinute · March 10, 2026