Broadcom Inc. - Common Stock (AVGO)

335.97

+0.00 (0.00%)

NASDAQ · Last Trade: Mar 13th, 6:16 AM EDT

Detailed Quote

| Previous Close | 335.97 |

|---|---|

| Open | - |

| Bid | 335.05 |

| Ask | 335.85 |

| Day's Range | N/A - N/A |

| 52 Week Range | 138.10 - 414.61 |

| Volume | 15,291 |

| Market Cap | 156.23B |

| PE Ratio (TTM) | 70.43 |

| EPS (TTM) | 4.8 |

| Dividend & Yield | 2.600 (0.77%) |

| 1 Month Average Volume | 25,119,286 |

Chart

About Broadcom Inc. - Common Stock (AVGO)

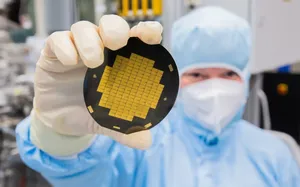

Broadcom Ltd is a global technology company that designs, develops, and supplies a wide range of semiconductor and infrastructure software solutions. The company specializes in producing chips that facilitate communication and data processing across various devices and networks, including those used in smartphones, enterprise storage systems, broadband access, and data centers. Additionally, Broadcom offers software solutions that enable businesses to optimize their operations, manage network security, and enhance performance across cloud-based and on-premises environments. Through its comprehensive portfolio, Broadcom plays a critical role in advancing connectivity and computing technologies in various industries. Read More

News & Press Releases

As of March 12, 2026, the global financial markets have undergone a profound transformation. The speculative fervor that defined the "AI hype" of 2023 and 2024 has matured into a disciplined, industrial-scale expansion. In what analysts are calling the "Year of Proof," the narrative has shifted from the mere possibility

Via MarketMinute · March 12, 2026

Explore how sector focus and portfolio diversity set these two leading dividend ETFs apart for income and growth-minded investors.

Via The Motley Fool · March 12, 2026

Expense ratios, sector tilts, and portfolio concentration set these two dividend ETFs apart for income-focused investors.

Via The Motley Fool · March 12, 2026

Spotlighting end-to-end AI infrastructure portfolio for gigawatt-scale clusters – spanning XPU, Ethernet, Optics, SerDes, DSP, and PCIe solutions

By Broadcom Inc. · Via GlobeNewswire · March 12, 2026

The enormous gains from a small handful of AI stocks can't be ignored any longer.

Via The Motley Fool · March 12, 2026

Expense ratios, sector focus, and yield differences set these two dividend ETFs apart for investors weighing income versus diversification.

Via The Motley Fool · March 12, 2026

On March 6, 2026, Broadcom CEO Hock Tan made a bold prediction during the earnings call: Broadcom expects its AI chip revenue to surpass $100 billion by 2027.

Via AB Newswire · March 12, 2026

As the global financial community prepares for NVIDIA’s (NASDAQ:NVDA) annual GPU Technology Conference (GTC), scheduled to begin on March 16, 2026, in San Jose, the stakes have never been higher for the semiconductor giant and the broader artificial intelligence sector. Often dubbed the "Super Bowl of AI," this

Via MarketMinute · March 12, 2026

AMD and Broadcom have been in impressive form on the stock market in the past year due to the growing adoption of their AI chips by hyperscalers.

Via The Motley Fool · March 12, 2026

Marvell Technology (NASDAQ:MRVL) has officially signaled a turnaround in its fiscal fourth-quarter 2026 earnings report, delivering record-breaking revenue and profit figures that have effectively pulled the semiconductor designer out of a prolonged period of market skepticism. Reporting on March 5, 2026, the company posted a blowout quarter driven by

Via MarketMinute · March 12, 2026

As the semiconductor industry hurtles toward a projected $1 trillion in annual sales, all eyes have turned to Broadcom Inc. (NASDAQ: AVGO) as it navigates a period of intense market scrutiny. Despite its pivotal role in the global AI infrastructure build-out, the company’s stock has recently weathered a turbulent

Via MarketMinute · March 12, 2026

As the closing bell prepares to ring on March 12, 2026, all eyes in the semiconductor sector are fixed on Semtech Corporation (Nasdaq: SMTC). Reporting its fourth-quarter and full-year fiscal 2026 earnings after the market close (AMC), the Camarillo-based chipmaker finds itself at a pivotal juncture. Once viewed as a cautionary tale of over-ambitious M&A [...]

Via Finterra · March 12, 2026

The opportunity is vast, but the road ahead is unclear.

Via The Motley Fool · March 12, 2026

AI stocks have tumbled significantly in 2026.

Via The Motley Fool · March 12, 2026

TSMC fell the most in the group, declining nearly 1% in Thursday’s premarket session.

Via Stocktwits · March 12, 2026

These companies offer products key to AI development.

Via The Motley Fool · March 11, 2026

Broadcom's latest earnings report and guidance left nothing to be desired.

Via The Motley Fool · March 11, 2026

Nvidia and Broadcom are both rock-solid AI investments.

Via The Motley Fool · March 11, 2026

The rapidly growing demand for fast data transmission in AI data centers is driving terrific growth for this company.

Via The Motley Fool · March 11, 2026

Taiwan Semiconductor and Broadcom are seeing huge growth thanks to AI.

Via The Motley Fool · March 11, 2026

As the global financial markets eye the San Jose Convention Center for the start of GTC 2026 on March 16, Nvidia (NASDAQ: NVDA) CEO Jensen Huang has once again sent shockwaves through the technology sector. In a series of pre-conference teasers, Huang promised the unveiling of a “world-surprising” chip—a

Via MarketMinute · March 11, 2026

Broadcom unveils the Taurus BCM83640 chip, enabling 1.6T data modules to supercharge AI data center efficiency and networking speed.

Via Benzinga · March 11, 2026

Via FinancialNewsMedia · March 11, 2026

Rob Sechan of NewEdge Wealth names Broadcom Inc. as final trade, citing strong AI chip demand. Spotify, AppLovin and Uber are also ...

Via Benzinga · March 11, 2026

Broadcom just delivered another strong quarterly result on the back of soaring demand for its AI data center hardware products.

Via The Motley Fool · March 11, 2026