Applied Materials (AMAT)

337.27

+0.00 (0.00%)

NASDAQ · Last Trade: Mar 13th, 7:36 AM EDT

Detailed Quote

| Previous Close | 337.27 |

|---|---|

| Open | - |

| Bid | 338.13 |

| Ask | 339.99 |

| Day's Range | N/A - N/A |

| 52 Week Range | 123.74 - 395.95 |

| Volume | 7,115 |

| Market Cap | 267.46B |

| PE Ratio (TTM) | 34.56 |

| EPS (TTM) | 9.8 |

| Dividend & Yield | 1.840 (0.55%) |

| 1 Month Average Volume | 7,743,709 |

Chart

About Applied Materials (AMAT)

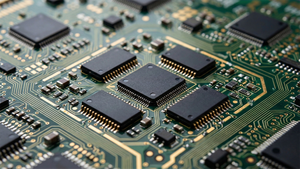

Applied Materials is a leading provider of equipment, services, and software for the semiconductor and display manufacturing industries. The company specializes in a range of technologies that enable the fabrication of advanced materials and components, crucial for powering devices such as smartphones, tablets, and computers. Through its innovative solutions, Applied Materials helps manufacturers improve their production processes, enhance the performance of their products, and drive advancements in electronics, renewable energy, and other high-tech sectors. The company's commitment to research and development positions it at the forefront of the ever-evolving landscape of materials engineering and chip manufacturing. Read More

News & Press Releases

SANTA CLARA, Calif., March 13, 2026 (GLOBE NEWSWIRE) -- Applied Materials, Inc. today announced that its Board of Directors has approved a 15-percent increase in the quarterly cash dividend, from $0.46 to $0.53 per share, payable on June 11, 2026 to shareholders of record as of May 21, 2026. This marks nine consecutive years of dividend increases.

By Applied Materials, Inc. · Via GlobeNewswire · March 13, 2026

The Nasdaq 100 (^NDX) is packed with high-growth companies, and while the market is competitive, some are pulling ahead. A handful of standout businesses are...

Via StockStory · March 12, 2026

Applied Materials and Micron have partnered to create next-gen memory chips for AI.

Via Barchart.com · March 11, 2026

On March 10, 2026, Oracle outperformed in after-hours trading and oil prices fell in a volatile, energy-driven session.

Via The Motley Fool · March 10, 2026

SANTA CLARA, Calif., March 10, 2026 (GLOBE NEWSWIRE) -- Applied Materials, Inc. today announced a long-term collaboration agreement with SK hynix Inc. to accelerate the development and deployment of next-generation DRAM and high-bandwidth memory (HBM) essential for AI and high-performance computing. Engineers from both companies will work side-by-side at Applied’s EPIC Center in Silicon Valley to advance innovation in materials, process integration and 3D advanced packaging as memory architectures move beyond current production nodes.

By Applied Materials, Inc. · Via GlobeNewswire · March 10, 2026

An expanding partnership is pushing Micron's shares higher.

Via The Motley Fool · March 10, 2026

Semiconductor equipment stocks, including Applied Materials, rose after Barclays raised estimates for chip gear spending this year and next.

Via Investor's Business Daily · March 10, 2026

Which S&P500 stocks are moving on Tuesday?chartmill.com

Via Chartmill · March 10, 2026

As of March 10, 2026, the semiconductor industry has moved far beyond the "chip shortage" era of the early 2020s, entering a decade defined by the relentless scaling requirements of Generative AI and high-performance computing. At the heart of this technological arms race stands Applied Materials, Inc. (NASDAQ: AMAT). While companies like NVIDIA design the [...]

Via Finterra · March 10, 2026

AMAT and Micron (MU) are rewriting the rules of AI hardware. Learn how their new Idaho-to-California partnership is solving AI's energy crisis and why experts believe this $5 billion investment makes both stocks bulletproof bets for the 2027 chip boom.

Via Benzinga · March 10, 2026

SANTA CLARA, Calif., March 10, 2026 (GLOBE NEWSWIRE) -- Applied Materials, Inc. today announced it is working with Micron Technology to develop next-generation DRAM, high-bandwidth memory (HBM) and NAND solutions that increase the energy-efficient performance of AI systems, bringing together advanced R&D capabilities from Applied’s EPIC Center in Silicon Valley and Micron’s state-of-the-art innovation center in Boise, Idaho to strengthen the semiconductor innovation pipeline in the United States.

By Applied Materials, Inc. · Via GlobeNewswire · March 10, 2026

Data from Stocktwits showed that retail sentiment on SPY and QQQ remains ‘bearish.’

Via Stocktwits · March 9, 2026

While profitability is essential, it doesn’t guarantee long-term success. Some companies that rest on their margins will lose ground as competition intensifi...

Via StockStory · March 9, 2026

Retail traders maintained a ‘neutral’ stance on MU amid concerning signals, including Nvidia choosing Korean and Chinese memory suppliers over Micron for its next-gen Vera Rubin hardware.

Via Stocktwits · March 8, 2026

The semiconductor industry has created massive wealth over the past decade. It is primed to continue, and this stock could be one of the biggest winners.

Via The Motley Fool · March 7, 2026

Via Benzinga · March 6, 2026

Discover the top S&P500 movers in Friday's pre-market session.chartmill.com

Via Chartmill · March 6, 2026

Today, March 5, 2026, chipmakers slid as fresh AI export scrutiny collided with oil-fueled inflation worries across U.S. stocks.

Via The Motley Fool · March 5, 2026

Via MarketBeat · March 4, 2026

A number of stocks fell in the afternoon session after fears of a global energy price shock hit the semiconductor sector following a sell-off in South Korea's stock market.

Via StockStory · March 3, 2026

As the National People’s Congress (NPC) convenes in Beijing this week, the formalization of China’s 15th Five-Year Plan (2026–2030) marks a definitive turning point in the global technological landscape. With a primary focus on "High-Quality Development" and the cultivation of what President Xi Jinping calls "New Productive

Via MarketMinute · March 3, 2026

Looking beyond the chipmakers may reveal some great growth opportunities at fair prices.

Via The Motley Fool · March 1, 2026

This Vanguard ETF is built around industry leaders like Nvidia, Apple, and Microsoft.

Via The Motley Fool · February 27, 2026

The battle against inflation took a sharp, unexpected turn this week as the U.S. Bureau of Labor Statistics released Producer Price Index (PPI) data for January 2026 that significantly overshot economist expectations. Coming on the final Friday of February, the report showed a 0.6% month-over-month jump in wholesale

Via MarketMinute · February 27, 2026