Recent Articles from PredictStreet

As of January 14, 2026, the financial landscape has undergone a seismic shift. What were once niche "betting" platforms for crypto enthusiasts have matured into a cornerstone of the modern retail brokerage experience. The primary catalyst? A wave of high-profile integrations by Robinhood Markets, Inc. (NASDAQ:HOOD), Coinbase Global, Inc. (NASDAQ:COIN), and Gemini, which have collectively [...]

Via PredictStreet · January 14, 2026

As of January 14, 2026, prediction markets are flashing a severe warning signal for the Middle East, with traders pricing in an overwhelming likelihood of a direct military strike on Iran by the United States or Israel this year. Current odds on major decentralized platforms have surged to a staggering 83% for a U.S. strike [...]

Via PredictStreet · January 14, 2026

As of mid-January 2026, the meteoric rise of prediction markets has hit a significant jurisdictional wall. Despite record-breaking daily trading volumes exceeding $700 million, the industry is currently navigating a chaotic "checkerboard" of state-level regulation that threatens to fragment the market. While federal courts have largely cleared a path for political and event-based derivatives, state [...]

Via PredictStreet · January 14, 2026

The landscape of information and finance reached a historic turning point this week as Kalshi, the leading U.S. regulated prediction market, announced a staggering $1 billion Series E funding round, valuing the company at $11 billion. This "decacorn" milestone, finalized in late December 2025, signals a paradigm shift in how global markets and the general [...]

Via PredictStreet · January 14, 2026

The long-debated question of whether massive trading volume leads to superior forecasting accuracy has finally been answered with a treasure trove of data. A groundbreaking study from Vanderbilt University, titled "Prediction Markets? The Accuracy and Efficiency of $2.4 Billion in the 2024 Presidential Election," has sent shockwaves through the financial and political communities. The study [...]

Via PredictStreet · January 14, 2026

The transition of power at the Federal Reserve has officially moved from a matter of speculation to a high-stakes duel in the prediction markets. As of January 14, 2026, the race to succeed Jerome Powell as Chair of the Federal Reserve has seen a dramatic shift in momentum. For months, the market had favored a [...]

Via PredictStreet · January 14, 2026

As of January 14, 2026, prediction markets are flashing a signal that would have been unthinkable just two years ago: a supermajority of traders believe the era of Ayatollah Ali Khamenei is coming to an end. On the decentralized platform Polymarket, the contract for Khamenei to exit office by the end of 2026 has climbed [...]

Via PredictStreet · January 14, 2026

On January 3, 2026, as U.S. Special Forces launched "Operation Absolute Resolve" to apprehend Venezuelan President Nicolás Maduro, the world watched in shock. But on the decentralized prediction platform Polymarket, the shock had already been priced in. Just hours before the first Delta Force boots hit the ground in Caracas, an anonymous user liquidated a [...]

Via PredictStreet · January 14, 2026

As the United States enters the second year of Donald Trump’s second term, the political landscape has reached a boiling point that prediction markets are now pricing as a coin-flip for a constitutional crisis. On Kalshi, the regulated exchange for event contracts, the probability of President Trump being impeached by the House of Representatives has [...]

Via PredictStreet · January 14, 2026

The prediction market industry reached a historic milestone on January 12, 2026, as total daily trading volume across major platforms surged to a staggering $701.7 million. This record-breaking figure represents the highest single-day turnover in the history of the sector, signaling the definitive arrival of event-based trading as a cornerstone of modern finance. At the [...]

Via PredictStreet · January 14, 2026

As the NFL transitions into the high-stakes Divisional Round, the dust is still settling on a Wild Card Weekend that defied the expectations of many traditional analysts but was precisely tracked by the "wisdom of the crowd." On social prediction platform Manifold Markets, the high-octane matchups between the Houston Texans and the Pittsburgh Steelers, as [...]

Via PredictStreet · January 13, 2026

As the clock struck midnight on January 1, 2026, a niche but high-volume corner of the prediction markets quietly resolved. The contract "Will Jesus Christ return in 2025?" on the decentralized platform Polymarket closed with a definitive "No," providing a modest 5.5% annualized return for the skeptics who had treated the "No" shares as a [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, the geopolitical landscape in the Middle East is reaching a boiling point, and nowhere is this tension more visible than in the world’s prediction markets. On platforms like Polymarket, the probability of a U.S. military strike on Iran by mid-year has surged to a staggering 71-80%, reflecting a market consensus [...]

Via PredictStreet · January 13, 2026

As the countdown to the expiration of Jerome Powell’s term begins, the prediction markets have narrowed the field for the next leader of the Federal Reserve to a two-man sprint. In what traders are calling the "Battle of the Kevins," former Fed Governor Kevin Warsh has narrowly overtaken former Council of Economic Advisers Chairman Kevin [...]

Via PredictStreet · January 13, 2026

As of mid-January 2026, the psychological and technical barrier of $100,000 remains the most contested territory in the digital asset space. While Bitcoin (BTC) entered the new year with a wave of euphoria that saw traders pricing in a nearly 80% chance of breaching the six-figure mark, reality has set in with sobering speed. Current [...]

Via PredictStreet · January 13, 2026

The night of January 11, 2026, marked a turning point for prediction markets as live betting odds from Polymarket were integrated directly into the Golden Globes broadcast on CBS (owned by Paramount Global, NASDAQ: PARA). This partnership with Penske Media Corporation aimed to mainstream "cultural betting," but it instead sparked a massive backlash from viewers [...]

Via PredictStreet · January 13, 2026

The world of prediction markets is facing its most significant legislative reckoning to date. Following a series of suspicious trades linked to high-stakes geopolitical events, Representative Ritchie Torres (D-NY) has introduced the "Public Integrity in Financial Prediction Markets Act of 2026." The bill seeks to explicitly criminalize insider trading on prediction platforms by government employees, [...]

Via PredictStreet · January 13, 2026

The early morning hours of January 3, 2026, will be remembered for the thundering rotors of U.S. special operations forces over Caracas. But for the high-stakes world of decentralized finance, the real "shock and awe" happened hours earlier on a digital scoreboard. As the world slept, an anonymous trader on the prediction platform Polymarket turned [...]

Via PredictStreet · January 13, 2026

The Ukrainian government has officially moved to block access to Polymarket, the world’s largest decentralized prediction platform, marking a significant escalation in the regulatory and ethical scrutiny of geopolitical betting. The ban, finalized in mid-January 2026, comes after months of mounting tension over the platform's "war markets," which allowed global speculators to wager on the [...]

Via PredictStreet · January 13, 2026

In a significant blow to state-level gambling regulators, a federal judge in Tennessee has temporarily halted the state’s attempt to shut down Kalshi’s sports prediction markets. On Monday, January 12, 2026, Judge Aleta Trauger of the U.S. District Court for the Middle District of Tennessee issued a temporary restraining order (TRO), preventing Tennessee officials from [...]

Via PredictStreet · January 13, 2026

Date: January 13, 2026 Introduction Amgen Inc. (NASDAQ: AMGN) finds itself at a historic crossroads. Long regarded as the "blue-chip" anchor of the biotechnology sector, the Thousand Oaks-based giant is currently attempting one of the most ambitious pivots in its 45-year history. While the company has built its multi-billion-dollar empire on bone health, oncology, and [...]

Via PredictStreet · January 13, 2026

Date: January 13, 2026 Introduction As the financial world turns its gaze toward the fourth-quarter earnings season of 2025, no institution commands as much scrutiny as The Goldman Sachs Group, Inc. (NYSE: GS). Long regarded as the apex predator of Wall Street, Goldman Sachs enters 2026 at a historic crossroads. After years of strategic turbulence [...]

Via PredictStreet · January 13, 2026

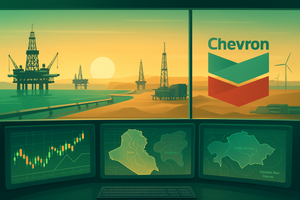

Chevron Corporation (NYSE: CVX) stands at a pivotal crossroads in the global energy landscape. While the industry continues its long-term pivot toward a lower-carbon future, the immediate geopolitical reality of 2026 has prioritized energy security and asset consolidation. Chevron is currently the center of global financial attention following its ambitious $22 billion bid to acquire [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, the financial technology landscape has moved far beyond the simple "buy button." For PayPal Holdings, Inc. (NASDAQ: PYPL), the journey from a pandemic-era darling to a value-stock turnaround story has been fraught with skepticism. However, a pivotal shift is underway. Under the leadership of CEO Alex Chriss, the company is [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, the landscape of Human Capital Management (HCM) is undergoing a profound transformation driven by artificial intelligence and a shift in how employees access their earnings. At the center of this evolution is Paychex, Inc. (NASDAQ: PAYX), a stalwart of the payroll industry that is currently navigating a pivotal fiscal year. [...]

Via PredictStreet · January 13, 2026

The aviation industry is still reeling from the tectonic shift announced just 48 hours ago: the $1.5 billion acquisition of Sun Country Airlines (NASDAQ: SNCY) by Allegiant Travel Company (NASDAQ: ALGT). This merger marks a definitive end to the "growth at all costs" era for ultra-low-cost carriers (ULCCs) and signals the dawn of a new, [...]

Via PredictStreet · January 13, 2026

The U.S. aviation landscape shifted dramatically this week as two of the industry’s most efficient leisure operators announced a definitive merger agreement. On January 11, 2026, Allegiant Travel Company (NASDAQ: ALGT) and Sun Country Airlines Holdings, Inc. (NASDAQ: SNCY) revealed a $1.5 billion cash-and-stock deal aimed at creating a dominant, diversified leisure powerhouse. The market’s [...]

Via PredictStreet · January 13, 2026

Date: January 13, 2026 Introduction As of early 2026, Exxon Mobil Corporation (NYSE: XOM) finds itself in an extraordinary position: a financial titan at the peak of its operational powers, yet locked in a high-stakes geopolitical game of chicken with the United States executive branch. While the company’s balance sheet has never looked stronger following [...]

Via PredictStreet · January 13, 2026

Date: January 13, 2026 Introduction The Boeing Company (NYSE: BA) stands today at one of the most significant pivot points in its 110-year history. After nearly a decade defined by safety crises, manufacturing lapses, and leadership turnover, the aerospace giant enters 2026 with a renewed focus on its industrial roots. Under the stewardship of CEO [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Johnson & Johnson (NYSE: JNJ) stands at a pivotal juncture in its nearly 140-year history. Once a sprawling conglomerate synonymous with baby shampoo and Band-Aids, the "New J&J" has emerged from the 2023 spin-off of its consumer health division, Kenvue, as a lean, high-margin healthcare powerhouse. Today, the company is [...]

Via PredictStreet · January 13, 2026

As we enter the second week of 2026, the global consumer goods landscape is facing a pivotal transformation. At the center of this evolution is The Procter & Gamble Company (NYSE: PG), a titan of industry that has become synonymous with "defensive investing." For decades, P&G has served as the bedrock of conservative portfolios, prized [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, the semiconductor industry has entered a new era characterized by a definitive shift in the balance of power. For decades, the narrative of Advanced Micro Devices, Inc. (NASDAQ: AMD) was one of a perennial underdog—a "second-source" supplier perpetually in the shadow of Intel Corporation. Today, that narrative has been rewritten. [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Intel Corporation (Nasdaq: INTC) stands at the most critical juncture in its 58-year history. After decades of undisputed dominance followed by a humbling period of market share loss and manufacturing delays, the company is mid-way through a "Silicon Renaissance." Today, Intel is no longer just a chip designer; it has [...]

Via PredictStreet · January 13, 2026

Date: January 13, 2026 Introduction Mirum Pharmaceuticals, Inc. (Nasdaq: MIRM) has reached a critical inflection point, evolving from a speculative clinical-stage biotech into a commercial-stage powerhouse in the rare liver disease sector. As of early 2026, the company stands as a beacon of growth in the biotechnology landscape, recently surpassing annual revenue targets and achieving [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Nike, Inc. (NYSE: NKE) stands at a pivotal juncture in its storied history. Once the undisputed monarch of the global sportswear market, the "Swoosh" spent much of 2024 and 2025 navigating a period of introspection and restructuring. Following a decade defined by a shift toward digital lifestyle sales and Direct-to-Consumer [...]

Via PredictStreet · January 13, 2026

Date: January 13, 2026 Introduction As the global defense landscape undergoes its most radical transformation since the end of the Cold War, L3Harris Technologies (NYSE: LHX) has emerged as a cornerstone of the modern "Arsenal of Democracy." Once viewed primarily as a second-tier provider of tactical radios and sensors, L3Harris has spent the last five [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Microsoft Corporation (NASDAQ: MSFT) stands at the pinnacle of the global technology hierarchy, recently crossing the historic $4 trillion market capitalization threshold. While the "Magnificent Seven" era of 2023-2024 defined the initial generative AI hype, 2026 has transitioned into what analysts call the "Year of Truth"—a period where the staggering [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Walmart Inc. (NYSE: WMT) stands as a global behemoth that has successfully navigated the most turbulent era in retail history. No longer just a chain of rural "everything stores," the Walmart of 2026 is a sophisticated, tech-driven ecosystem blending physical proximity with digital dominance. With annual revenues crossing the $700 [...]

Via PredictStreet · January 13, 2026

Meta Platforms, Inc. is no longer just a collection of social apps; it has evolved into a vertically integrated technology titan spanning silicon design, frontier AI models, and spatial computing hardware. In early 2026, Meta is in focus because it represents the purest public equity play on the "Agentic AI" revolution—the shift from chatbots that [...]

Via PredictStreet · January 13, 2026

Date: January 13, 2026 Introduction Micron Technology, Inc. (NASDAQ: MU) has transitioned from a cyclical commodity manufacturer to a cornerstone of the global Artificial Intelligence (AI) infrastructure. As of early 2026, the Boise-based memory giant is no longer just a participant in the semiconductor market; it is a primary gatekeeper for the high-performance computing era. [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Apple Inc. (NASDAQ: AAPL) remains the most scrutinized and significant entity in the global technology landscape. With a market capitalization hovering near the $4 trillion threshold, the Cupertino-based giant is no longer just a hardware manufacturer; it is a sprawling digital ecosystem that defines modern consumer habits. This article examines [...]

Via PredictStreet · January 13, 2026

Date: January 13, 2026 Introduction As of early 2026, Alphabet Inc. (NASDAQ: GOOGL) stands at the pinnacle of the global technology landscape, having successfully transitioned from a search-centric giant into a diversified "AI-first" conglomerate. Following a year of historic financial milestones—including its first-ever $100 billion revenue quarter in late 2025—Alphabet has silenced critics who once [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, NVIDIA Corporation (NASDAQ: NVDA) stands not merely as a semiconductor manufacturer, but as the foundational architect of the "Intelligence Age." Just days after concluding a triumphant showing at CES 2026, the company finds itself at a unique crossroads: it has achieved a historic $5 trillion market capitalization, yet it faces [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Wells Fargo & Company (NYSE: WFC) stands at a historic crossroads. For nearly a decade, the San Francisco-based banking giant was the "problem child" of the American financial sector, shackled by a punitive Federal Reserve asset cap and a reputation tarnished by a 2016 retail sales scandal. However, the narrative [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Bank of America Corporation (NYSE: BAC) stands as a titan of the global financial sector, representing both a bellwether for the American consumer and a sophisticated engine for global capital markets. Following a year of economic recalibration in 2025—marked by a "soft landing" in the United States and a stabilizing [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, American Express Company (NYSE: AXP) finds itself at a pivotal crossroads between record-breaking financial performance and a sudden shift in the regulatory winds. After a stellar 2025 that saw the stock reach all-time highs, the "Blue Box" is currently navigating a "policy shock" triggered by renewed political focus on credit [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Synchrony Financial (NYSE: SYF) stands at a fascinating crossroads between fundamental financial strength and significant regulatory turbulence. Once a quiet subsidiary of the General Electric empire, Synchrony has evolved into the largest provider of private-label credit cards in the United States. While the company spent much of 2025 celebrating a [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Citigroup Inc. (NYSE: C) stands at a pivotal junction in its storied history. Once the "troubled child" of the American banking sector, the firm has spent the last three years under the leadership of CEO Jane Fraser undergoing a radical, surgical transformation. For decades, Citigroup was synonymous with complexity—a sprawling [...]

Via PredictStreet · January 13, 2026

Date: January 13, 2026 Introduction As of early 2026, Capital One Financial Corporation (NYSE: COF) stands at the pinnacle of the American consumer lending landscape. Following the seismic completion of its acquisition of Discover Financial Services in May 2025, the McLean, Virginia-based firm has transformed from a major credit card issuer into a vertically integrated [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, the global Business Process Outsourcing (BPO) landscape is undergoing its most radical transformation since the dawn of the internet. At the center of this storm is Concentrix Corporation (Nasdaq: CNXC), a company that has spent the last five years evolving from a traditional customer service provider into a technology-driven "Customer [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, Delta Air Lines (NYSE: DAL) stands at a historic crossroads. Having just celebrated its centennial anniversary in 2025, the Atlanta-based carrier has transformed itself from a traditional legacy airline into what management describes as a "premium-first lifestyle brand." Today, Delta is in sharp focus following its Q4 2025 earnings release, [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, The Bank of New York Mellon Corporation (NYSE: BK), now operating under the streamlined brand BNY, stands as a titan of the global financial plumbing. Often described as the "bank of banks," BNY has transcended its traditional role as a legacy trust institution to become a dominant, technology-led financial platforms [...]

Via PredictStreet · January 13, 2026

As of January 13, 2026, JPMorgan Chase & Co. (NYSE: JPM) stands not just as a survivor of the various economic upheavals of the 21st century, but as the undisputed titan of the global financial landscape. Today’s earnings release for the fourth quarter of 2025 has once again underscored why the "Fortress Balance Sheet" is [...]

Via PredictStreet · January 13, 2026

As of January 9, 2026, Eli Lilly and Company (NYSE:LLY) has transitioned from a stalwart of the American pharmaceutical industry to a global financial phenomenon. Having recently crossed the historic $1 trillion market capitalization threshold in late 2025—the first pure-play pharmaceutical company to do so—Lilly is no longer just a drugmaker; it is a macroeconomic [...]

Via PredictStreet · January 9, 2026

As of January 9, 2026, Advanced Micro Devices, Inc. (NASDAQ: AMD) stands at a pivotal crossroads in the global technology landscape. Once a perennial underdog in the shadow of giants, AMD has transformed into the primary challenger to Nvidia’s dominance in the artificial intelligence (AI) era. The semiconductor sector has faced significant volatility over the [...]

Via PredictStreet · January 9, 2026

Today’s Date: January 9, 2026 Ticker: (NASDAQ: AVGO) Introduction As we enter 2026, Broadcom Inc. (NASDAQ: AVGO) has evolved from a quiet giant of the semiconductor world into the indispensable backbone of the generative AI era. Once known primarily as a diversified "house of brands" for specialized chips and infrastructure software, Broadcom now sits at [...]

Via PredictStreet · January 9, 2026

As of early 2026, Netflix, Inc. (NASDAQ: NFLX) has transcended its origins as a disruptive tech startup to become the undisputed gravity center of the global media ecosystem. While once categorized purely as a "Silicon Valley" interloper, Netflix today operates with the scale of a traditional studio conglomerate and the agility of a software giant. [...]

Via PredictStreet · January 9, 2026

As of January 9, 2026, the global retail landscape is defined by a paradoxical "mixed" jobs market—one where low hiring rates and cooling wage growth coexist with resilient, albeit selective, consumer spending. In this environment of "pocketbook anxiety," Costco Wholesale Corporation (NASDAQ: COST) has emerged not just as a retailer, but as a financial fortress [...]

Via PredictStreet · January 9, 2026

As of January 9, 2026, Amazon.com, Inc. (NASDAQ: AMZN) stands at a pivotal junction between its heritage as the world’s most dominant e-commerce platform and its future as a vertically integrated AI and infrastructure powerhouse. While many investors still associate the company primarily with brown boxes and Prime delivery, the Amazon of 2026 is increasingly [...]

Via PredictStreet · January 9, 2026

As of January 9, 2026, Microsoft Corporation (NASDAQ: MSFT) stands not merely as a software giant, but as the foundational utility of the global artificial intelligence economy. In a market narrative dominated by the insatiable demand for compute power and the race for "agentic" AI, Microsoft has successfully vertically integrated its operations—from custom-designed silicon and [...]

Via PredictStreet · January 9, 2026

As of January 9, 2026, Apple Inc. (NASDAQ: AAPL) stands at a critical juncture in its nearly 50-year history. Traditionally viewed as the world’s premier hardware innovator, the Cupertino giant is currently navigating a profound transformation into an "Intelligence-first" enterprise. This shift comes against a backdrop of broader market volatility following the latest U.S. jobs [...]

Via PredictStreet · January 9, 2026

Today’s Date: January 9, 2026 Introduction As we enter early 2026, United Natural Foods, Inc. (NYSE: UNFI) stands at a critical juncture in its multi-year transformation. Once a darling of the organic movement, UNFI spent much of the early 2020s grappling with the complex integration of its SUPERVALU acquisition and a post-pandemic supply chain hangover. [...]

Via PredictStreet · January 9, 2026

As of January 9, 2026, WW International, Inc. (NASDAQ: WW), better known as WeightWatchers, stands at the most pivotal juncture in its 63-year history. After a tumultuous 2024 and 2025 that saw the rise of GLP-1 medications effectively disrupt the traditional weight-loss market, the company has emerged from a "pre-packaged" Chapter 11 restructuring with a [...]

Via PredictStreet · January 9, 2026

The following research report analyzes Kratos Defense & Security Solutions (NASDAQ: KTOS) as of January 9, 2026. PredictStreet provides deep-dive research and AI-driven insights into the defense-technology nexus. Introduction Kratos Defense & Security Solutions (NASDAQ: KTOS) is currently the centerpiece of a paradigm shift in global warfare: the transition from high-cost "exquisite" platforms to "attritable [...]

Via PredictStreet · January 9, 2026

As of January 9, 2026, the global computing landscape has transitioned from the "AI Hype" era into the "AI Implementation" era. At the epicenter of this transition sits Super Micro Computer, Inc. (NASDAQ: SMCI). Once a niche player in the server market, SMCI has evolved into a cornerstone of the AI data center ecosystem. However, [...]

Via PredictStreet · January 9, 2026

Today’s Date: January 9, 2026 Introduction In the landscape of American retail, few names evoke as much consistency and curiosity as Ross Stores, Inc. (NASDAQ: ROST). As we enter 2026, the retail sector finds itself at a crossroads, caught between stubborn inflationary pressures and a shifting consumer demographic. Yet, Ross Stores—the nation’s second-largest off-price retailer—continues [...]

Via PredictStreet · January 9, 2026

Date: January 9, 2026 By: PredictStreet Research Desk Introduction The technology sector witnessed a dramatic reshuffling in early 2026, and at the heart of this transformation is SanDisk Corporation (NASDAQ: SNDK). Today, shares of the newly independent flash memory giant surged by 8.23%, closing at approximately $362. This move follows a string of optimistic sales [...]

Via PredictStreet · January 9, 2026

The global maintenance products market received a jolt this morning as the WD-40 Company (NASDAQ: WDFC), the San Diego-based titan of lubricants and household chemicals, reported a surprising earnings miss. While the company is widely regarded as a "boring" but reliable compounder, its fiscal 2026 first-quarter results have sparked significant debate on Wall Street. Today [...]

Via PredictStreet · January 9, 2026

As of January 9, 2026, the global technology ecosystem finds itself at a critical juncture, and all eyes are fixed on a single company in Hsinchu, Taiwan. Taiwan Semiconductor Manufacturing Company (NYSE: TSM), the world’s largest and most advanced dedicated independent semiconductor foundry, is set to report its fourth-quarter 2025 earnings next week on January [...]

Via PredictStreet · January 9, 2026

Today’s Date: January 9, 2026 Introduction As the financial world pivots toward a pivotal 2026, all eyes are once again fixed on 200 West Street. The Goldman Sachs Group, Inc. (NYSE: GS) is set to report its fourth-quarter and full-year 2025 earnings next week, and the stakes have rarely been higher. Following a "renaissance year" [...]

Via PredictStreet · January 9, 2026

As the financial world turns its eyes to the start of the 2026 earnings season next week, no institution commands more attention than JPMorgan Chase & Co. (NYSE: JPM). Often described as the "Fortress Balance Sheet" of the American economy, JPMorgan is not merely a bank; it is a global financial utility that has successfully [...]

Via PredictStreet · January 9, 2026

Introduction As of today, January 9, 2026, Alphabet Inc. (NASDAQ: GOOGL) stands at the pinnacle of a technological and financial renaissance. Just two years ago, the company faced an existential narrative crisis, with critics suggesting that the rise of generative AI would "kill" search and leave Google in the dust of more nimble competitors. Instead, [...]

Via PredictStreet · January 9, 2026

Date: January 9, 2026 Introduction Meta Platforms, Inc. (NASDAQ: META) has entered 2026 in the midst of its most ambitious transformation since the transition from desktop to mobile. Once perceived primarily as a social media conglomerate, Meta has aggressively repositioned itself as an "AI-First" infrastructure and hardware powerhouse. The company’s current relevance is underscored by [...]

Via PredictStreet · January 9, 2026

The narrative surrounding Micron Technology, Inc. (NASDAQ: MU) has undergone a fundamental transformation over the last 24 months. Once viewed as a cyclical commodity play—a stock that investors bought at the bottom of the memory "bust" and sold at the peak of the "boom"—Micron has reinvented itself as a structural pillar of the artificial intelligence [...]

Via PredictStreet · January 9, 2026

Today, January 9, 2026, Vistra Corp (NYSE: VST) stands at the epicenter of a historic realignment in the global energy sector. Once viewed as a cyclical utility play, Vistra has successfully rebranded itself as a mission-critical provider of "AI infrastructure" through its unique combination of nuclear baseload and flexible gas generation. As the stock emerges [...]

Via PredictStreet · January 9, 2026