Mobile game developer Skillz (NYSE:SKLZ) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 8.2% year on year to $27.37 million. Its GAAP loss of $0.58 per share was 56.7% above analysts’ consensus estimates.

Is now the time to buy Skillz? Find out by accessing our full research report, it’s free.

Skillz (SKLZ) Q2 CY2025 Highlights:

- Revenue: $27.37 million vs analyst estimates of $22.82 million (8.2% year-on-year growth, 19.9% beat)

- EPS (GAAP): -$0.58 vs analyst estimates of -$1.34 (56.7% beat)

- Adjusted EBITDA: -$10.39 million vs analyst estimates of -$13.85 million (-38% margin, 25% beat)

- Operating Margin: -24%, down from 101% in the same quarter last year

- Free Cash Flow was -$22.5 million compared to -$12.66 million in the previous quarter

- Paying Monthly Active Users: 146,000, up 24,000 year on year

- Market Capitalization: $112.3 million

Company Overview

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

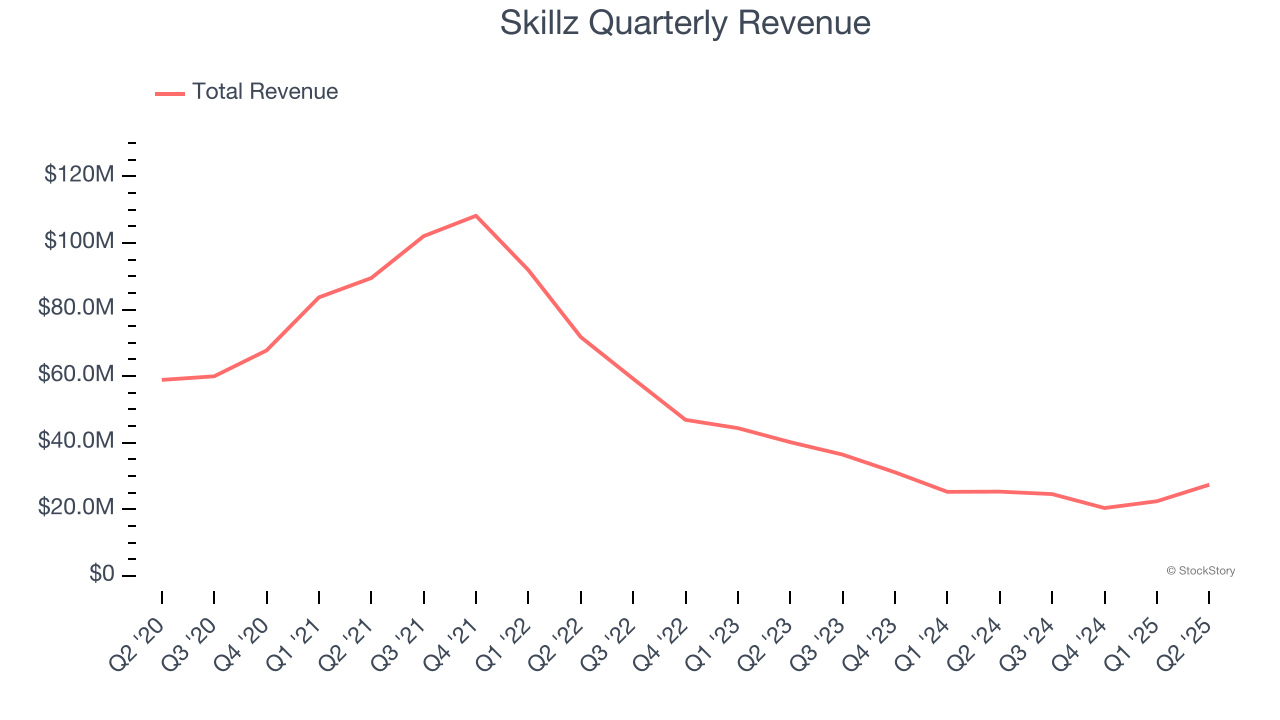

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Skillz struggled to consistently generate demand over the last three years as its sales dropped at a 36.7% annual rate. This was below our standards and suggests it’s a low quality business.

This quarter, Skillz reported year-on-year revenue growth of 8.2%, and its $27.37 million of revenue exceeded Wall Street’s estimates by 19.9%.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Paying Monthly Active Users

User Growth

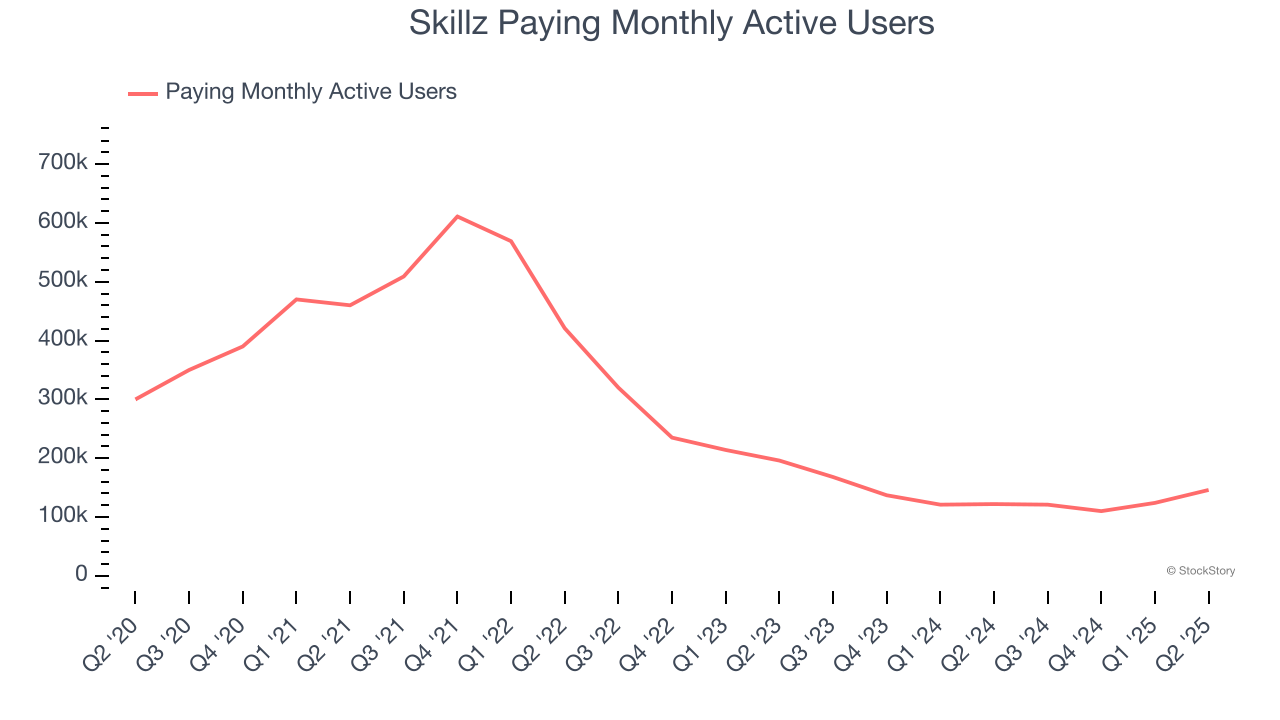

As a video gaming company, Skillz generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Skillz struggled with new customer acquisition over the last two years as its paying monthly active users have declined by 24.5% annually to 146,000 in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Skillz wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

Luckily, Skillz added 24,000 paying monthly active users in Q2, leading to 19.7% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

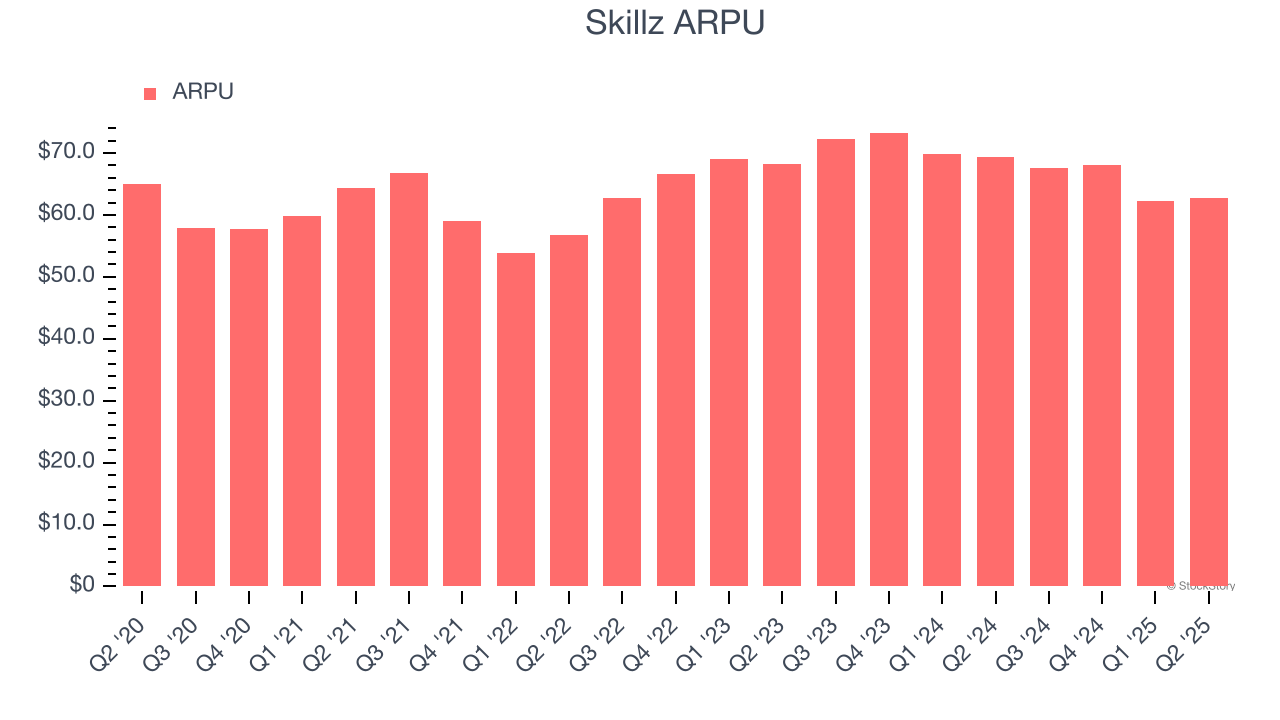

Average revenue per user (ARPU) is a critical metric to track because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

Skillz’s ARPU has been roughly flat over the last two years. This raises questions about its platform’s health when paired with its declining paying monthly active users. If Skillz wants to increase its users, it must either develop new features or provide some existing ones for free.

This quarter, Skillz’s ARPU clocked in at $62.80. It declined 9.5% year on year, worse than the change in its paying monthly active users.

Key Takeaways from Skillz’s Q2 Results

We were impressed by how significantly Skillz blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 6.6% to $7.08 immediately after reporting.

Sure, Skillz had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.