Since October 2024, Insperity has been in a holding pattern, posting a small loss of 4.5% while floating around $81.20. However, the stock is beating the S&P 500’s 14.1% decline during that period.

Is now the time to buy Insperity, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the strong relative performance, we're sitting this one out for now. Here are three reasons why NSP doesn't excite us and a stock we'd rather own.

Why Is Insperity Not Exciting?

Pioneering the professional employer organization (PEO) industry it helped establish, Insperity (NYSE:NSP) provides human resources outsourcing services to small and medium-sized businesses, handling payroll, benefits, compliance, and HR administration.

1. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Insperity’s revenue to rise by 4.9%, close to its 5.3% annualized growth for the past two years. This projection is underwhelming and suggests its newer products and services will not lead to better top-line performance yet.

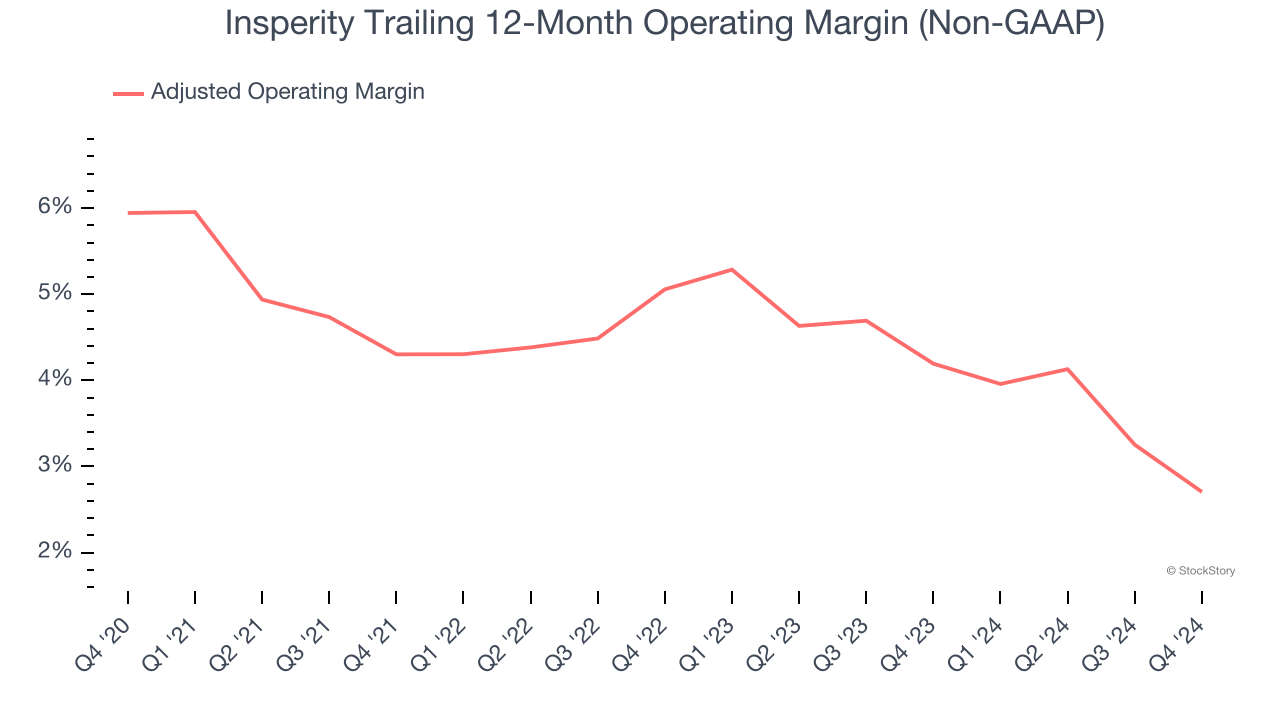

2. Shrinking Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Looking at the trend in its profitability, Insperity’s adjusted operating margin decreased by 3.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Insperity’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was 2.7%.

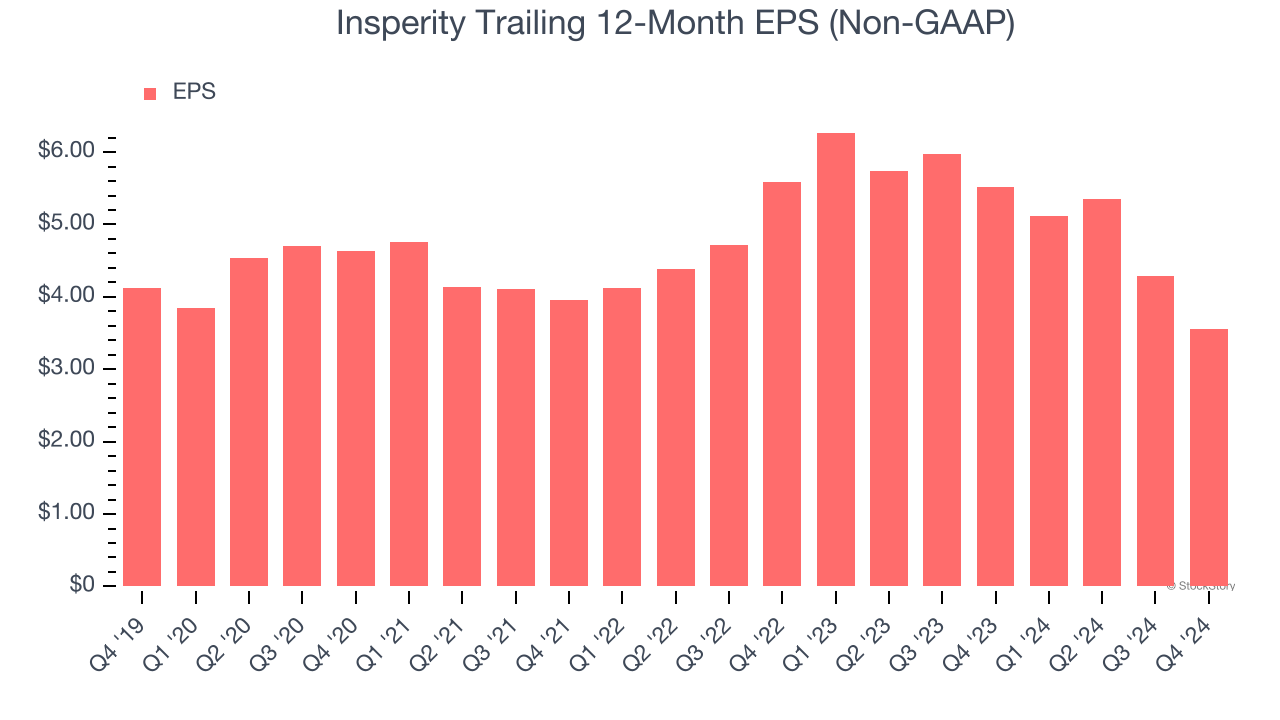

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Insperity, its EPS declined by 2.9% annually over the last five years while its revenue grew by 8.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Insperity isn’t a terrible business, but it doesn’t pass our quality test. Following its recent outperformance amid a softer market environment, the stock trades at 23.7× forward price-to-earnings (or $81.20 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Insperity

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.