First American Financial has been treading water for the past six months, recording a small loss of 0.5% while holding steady at $59.67. The stock also fell short of the S&P 500’s 27.9% gain during that period.

Is now the time to buy First American Financial, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think First American Financial Will Underperform?

We're swiping left on First American Financial for now. Here are three reasons we avoid FAF and a stock we'd rather own.

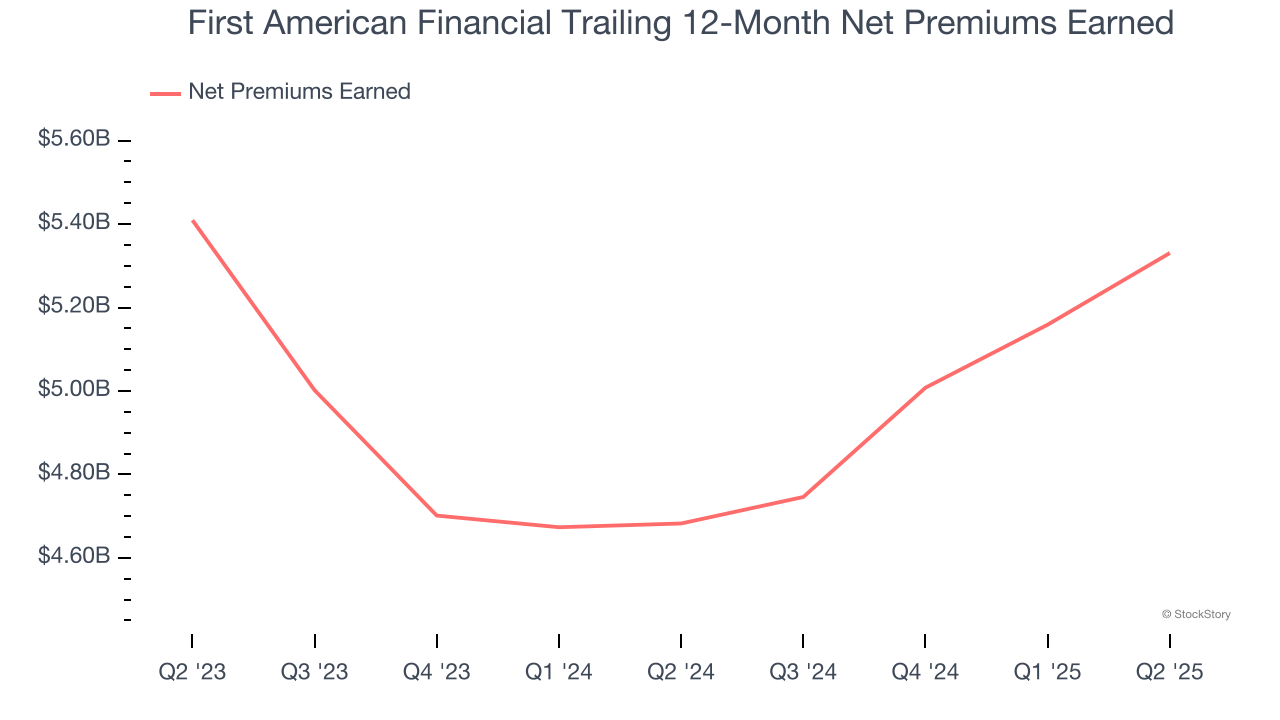

1. Net Premiums Earned Hit a Plateau

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

First American Financial’s net premiums earned was flat over the last two years, much worse than the broader insurance industry and in line with its total revenue.

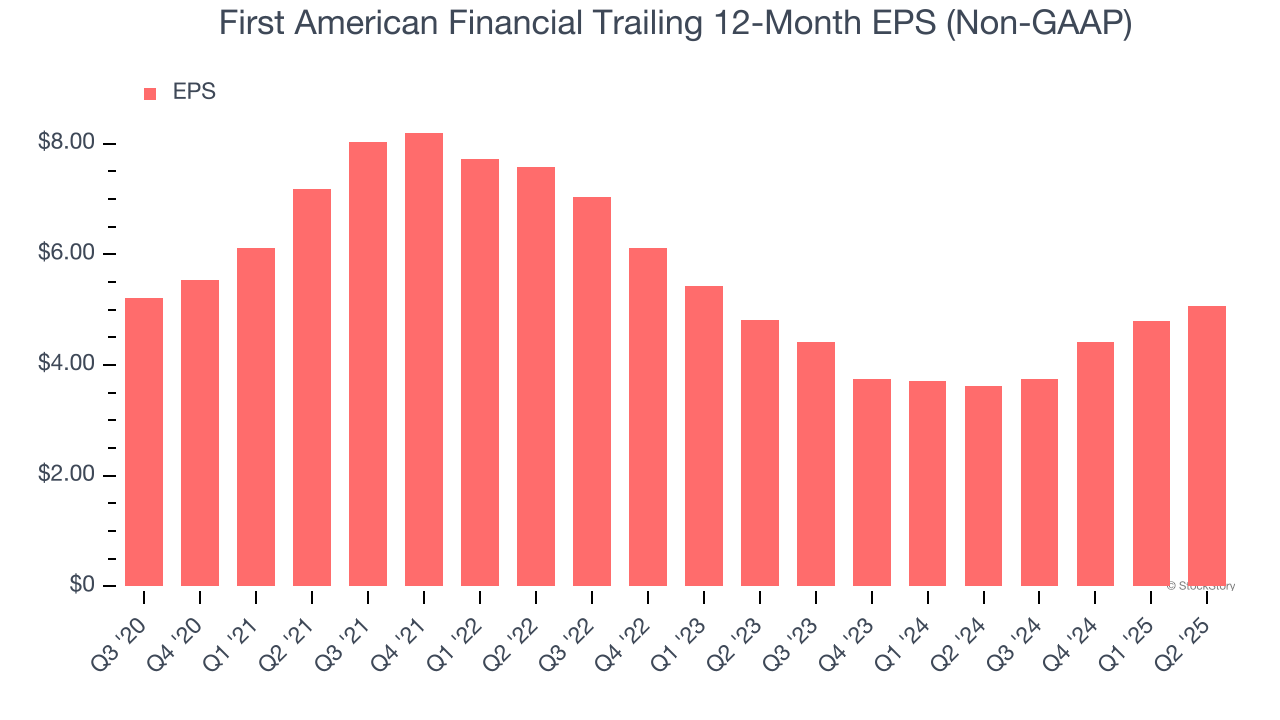

3. EPS Growth Has Stalled

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

First American Financial’s EPS was flat over the last five years, just like its revenue. This performance was underwhelming across the board.

Final Judgment

First American Financial falls short of our quality standards. With its shares underperforming the market lately, the stock trades at 1.1× forward P/B (or $59.67 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of First American Financial

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.