Highlights:

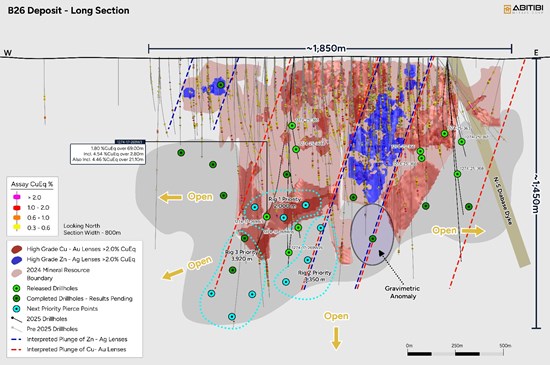

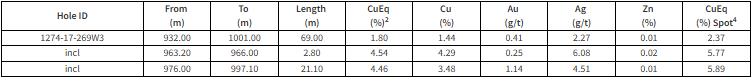

- Improved Copper Grade Following Overlimit Assays: Final results from hole 1274-17-269W3 returned an updated intercept of 4.46% CuEq over 21.1 metres (previously 3.65% CuEq), within a broader interval of 1.8% CuEq over 69.0 metres (previously 1.55% CuEq), starting at a downhole depth of 932 metres. These enhanced grades further highlight the strength of the copper-gold mineralization at the B26 Deposit.

- Torque to Rising Gold and Silver Prices: The B26 Deposit benefits from significant gold and silver credits that enhance the overall copper-equivalent grade. Using spot metal prices, the headline intercept from hole 1274-17-269W3 increases to 5.89% CuEq over 21.1 metres4, reflecting the contribution of a 1.14 g/t gold credit. This highlights the deposit’s strong leverage to precious metal prices and its potential to deliver enhanced value in a rising gold and silver price environment.

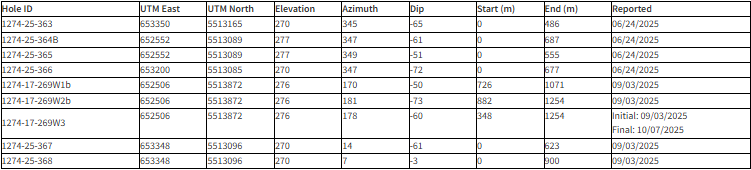

- Phase 3 Drill Program Expanded to 20,000 Metres: Based on the success of hole 269W3 and encouraging visual mineralization observed in subsequent holes, Abitibi Metals has expanded the ongoing Phase 3 program to 20,000 metres.

- Three Rigs Advancing Under Phase 3: The drill campaign continues with three active rigs, utilizing IMDEX directional drilling technology. Phase 3 is on track for completion by the end of November.

London, Ontario–(October 9, 2025) – Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) (FSE:FW0) (“Abitibi” or the “Company“) is pleased to announce the expansion of its Phase 3 drill program at the B26 polymetallic deposit in Québec to 20,000 metres, alongside the release of final assay results from hole 1274-17-269W3. Drilling continues to successfully intersect mineralization outside of the current Mineral Resource Estimate (“MRE”), confirming the potential to expand the mineralized footprint.

Abitibi currently holds a 50% interest in the B26 Deposit and retains the option to earn an additional 30% from SOQUEM Inc. (“SOQUEM”), a subsidiary of Investissement Québec (see November 16, 2023 News Release).

Three drill rigs are active on site, focused on high-priority expansion targets along the western and down-plunge extensions of the B26 system. Final overlimit copper assays from hole 1274-17-269W3 have returned an upgraded intercept of 4.46% CuEq over 21.1 metres, representing an increase of 22% from the previously reported 3.65% CuEq. This updated result further underscores the strength and continuity of the copper-gold system at B26.

Hole 269W3 represents one of the most robust intercepts to date in the western plunge, validating the high-grade growth potential of this zone, supported by a meaningful gold credit. The hole successfully tested a large gap in the current drill pattern, located approximately 80 metres down-dip from hole 1274-17-260, which returned 2.56% CuEq over 10.0 metres within a broader 1.26% CuEq over 28.5 metres. The comparison suggests increasing grade and width with depth.

Based on this world-class intercept and consistently strong visual mineralization observed in follow-up drilling, the Company has expanded the Phase 3 program from its original scope to 20,000 metres, aimed at unlocking further growth in the high-grade western plunge area.

“We are extremely encouraged by the final results from 269W3, which demonstrate world-class copper grades,” said Jonathon Deluce, CEO of Abitibi Metals. “As a result, we are expanding the Phase 3 drill program through the end of the year to 20,000 metres, with a focus on the high-grade western plunge of the system, where we are also seeing strong gold enrichment. This phase will include aggressive step-out drilling — up to 500 metres from the current B26 Resource — to test the broader expansion potential and to vector in on the potential source of this copper-gold stringer system.”

Figure 1: B26 Long Section highlighting 1274-17-269W1 & Updated Drill Plan

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11775/269745_6c32d5f764e23bb3_001full.jpg

Table 1: Final 1274-17-269W3

Note 1: The intercepts above are not necessarily representative of the true width of mineralization. The local interpretation indicates core length corresponding generally to 40 to 70% of the mineralized lens’ true width.

Note 2: Copper equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $2,500/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90.0% for gold, 96.1% for zinc, 72.1% for silver.

Note 3: Intervals are generally composited starting with a 0.1% CuEq cut-off and between 0.6% CuEq cut-off grade for the “including” intervals, allowing for up to 3 consecutive samples below cut-off grade.

Note 4: Spot copper equivalent values calculated using metal prices of $5.00/lb Cu, $1.35/lb Zn, $48.00/ounce Ag and $3,900/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90.0% for gold, 96.1% for zinc, 72.1% for silver.

Table 2: Phase 3 Drill Hole Information

Note 1: Numbers have been rounded to the nearest whole number in the table above.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Mr. Louis Gariépy, P.Eng (OIQ #107538), VP Exploration of Abitibi Metals, who is a “qualified person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Abitibi Metals Corp:

Abitibi Metals Corp. (CSE: AMQ) is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi’s portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a resource estimate1 of 11.3MT @ 2.13% Cu Eq (Ind- 1.23% Cu, 1.27% Zn, 0.46 g/t Au and 31.9 g/t Ag) & 7.2MT @ 2.21% Cu Eq (Inf – 1.56% Cu, 0.17% Zn, 0.87 g/t Au and 7.4 g/t Ag), and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres (BE13-038) and 13.07 g/t gold over 8.75 metres (BE12-014) amongst four modeled zones.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

ON BEHALF OF THE BOARD,

Jonathon Deluce, Chief Executive Officer

For more information, please call 226-271-5170, email info@abitibimetals.com, or visit https://www.abitibimetals.com.

The Company also maintains an active presence on various social media platforms to keep stakeholders and the general public informed and encourages shareholders and interested parties to follow and engage with the Company through the following channels to stay updated with the latest news, industry insights, and corporate announcements:

Twitter: https://twitter.com/AbitibiMetals

LinkedIn: https://www.linkedin.com/company/abitibi-metals-corp-amq-c/

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Note 1: Technical Report NI 43-101 Resource Estimation Update Project B26, Quebec, For Abitibi Metals Corp., By SGS Canada Inc., Yann Camus, ing., Olivier Vadnais-Leblanc, géo., SGS Canada – Geostat., Effective Date: November 1, 2024, Date of Report: February 26, 2025

Forward-looking statement:

This news release contains certain statements, which may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information involves statements that are not based on historical information but rather relate to future operations, strategies, financial results or other developments on the B26 Project or otherwise. Forward-looking information is necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on the Company’s behalf. Although Abitibi has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully, and readers should not place undue reliance on Abitibi’s forward-looking information. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects,” “estimates,” “anticipates,” or variations of such words and phrases (including negative and grammatical variations) or statements that certain actions, events or results “may,” “could,” “might” or “occur. Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability of the Company to successfully develop current or proposed projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons, among others. There is no assurance that the Company will be successful in achieving commercial mineral production and the likelihood of success must be considered in light of the stage of operations.

Featured Image @ Freepik

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube