Vancouver, British Columbia--(Newsfile Corp. - October 9, 2025) - Myriad Uranium Corp. (CSE: M) (OTCQB: MYRUF) (FSE: C3Q) ("Myriad" or the "Company") is pleased to announce that the Bureau of Land Management has approved a Plan of Operations for the Company's Copper Mountain Project Area. The Plan of Operations was submitted as a technical amendment to the existing Drilling Notification in place for the 2024 Drilling Season and allows for an expanded footprint of activities up to 222 boreholes across the Project, including high-priority targets such as Lucky Cliff which has exciting historical intercepts. Currently, under the existing Drilling Notification with the State of Wyoming, Myriad is bonded for 70 of those holes. The Drilling Notification can be updated to bond the remaining holes in subsequent phases. This is a major step forward for the Project and will enable Myriad to demonstrate the broader potential of the Copper Mountain District beyond the Canning Deposit.

Myriad CEO Thomas Lamb commented: "Having verified much of the original drilling conducted by Union Pacific at Canning, we now have the permit we need to continue drilling not only at Canning, but also at other target areas to confirm the entire Project's vast potential."

Plan of Operations

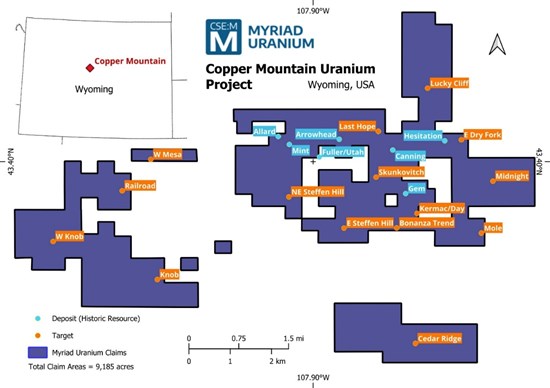

The approved Plan of Operations (the "Plan") allows for the drilling of up to 222 holes at numerous targets across the Copper Mountain Project Area. Currently, under the existing Drilling Notification with the State of Wyoming, Myriad is bonded for 70 of those holes, 50 of which were carried over from Canning during the previous drilling season in 2024. The Plan will be amended and additional drilling bonded on an ongoing basis as the Company's exploration strategy for Copper Mountain progresses. The areas currently covered by the Plan include Mint, Arrowhead, Lucky Cliff and Gem, as well as additional drilling at Canning. The Company's strategy is to continue to confirm the presence of historically identified mineralization while also demonstrating the broader potential of Copper Mountain to host many more large deposits, as was discussed in the Company's October 1, 2025 news release which can be viewed here. Union Pacific had plans to advance development at the seven historical resource estimate areas and continue exploration at 15 other target areas with known mineralization during the 1980s, but these plans were cut short by the Three Mile Island incident in 1979, which had a major negative impact on the uranium sector and the commodity price, particularly in the USA. In addition to the targets currently allowed for in the Plan, several others such as Hesitation, Fuller, Knob and Cedar Ridge may be considered in the near-term for drilling, pending amendments to the approved Plan.

The additional target areas included on the Plan of Operations have confirmed uranium mineralisation, as described in historic reports by Union Pacific and summarised in a Technical Report by Howe (1997):

Arrowhead: The Arrowhead Mine area included the historic Arrowhead-Little Moe Mine which, according to public records, produced in excess of 500,000 lbs of uranium at a recorded grade of 1,500 ppm U3O8 from shallow underground workings in Tertiary sediments during the 1950s and 1960s. Union Pacific estimated that significant uranium remains in the Tertiary sediments at Arrowhead and possibly in the underlying granites.

Lucky Cliff: Union Pacific drilled 22 holes at Lucky Cliff and intersected relatively shallow mineralization hosted in faulted granite in several very thick, shallow mineralization of up to 108 metres (355 feet) thick starting at 59 feet.

Gem: The Gem deposit was estimated by Union Pacific to contain Indicated and Inferred resources of 3.07 Mt containing 1.44 Mlbs eU3O8 at an average grade of 234 ppm eU3O8 (Union Pacific/RMEC, 1977). Mineralisation at the Gem deposit occurs within granitic rocks in the top 60 metres (200 feet) from the surface. Several thousand tons of uraniferous granite was reportedly mined from the Gem deposit in the 1950's by a prospector and stockpiled in the vicinity of the mine. None of this material was shipped for milling.

Mint (Fuller West): At least 50 holes were drilled by Union Pacific at the Mint deposit. The deposit was reported (Fluor, 1980) to contain Indicated and Inferred resources of 3.68 Mt containing 1.41 Mlbs of eU3O8 at an average grade of 141 ppm eU3O8. Mineralization is hosted in granitic basement and overlying sediment.

A qualified person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves; and Myriad Uranium is not treating the historical estimates as current mineral resources or mineral reserves. See notes for disclosure below.

Union Pacific reported that all areas have significant expansion potential beyond known mineralization, including at depth.

Background

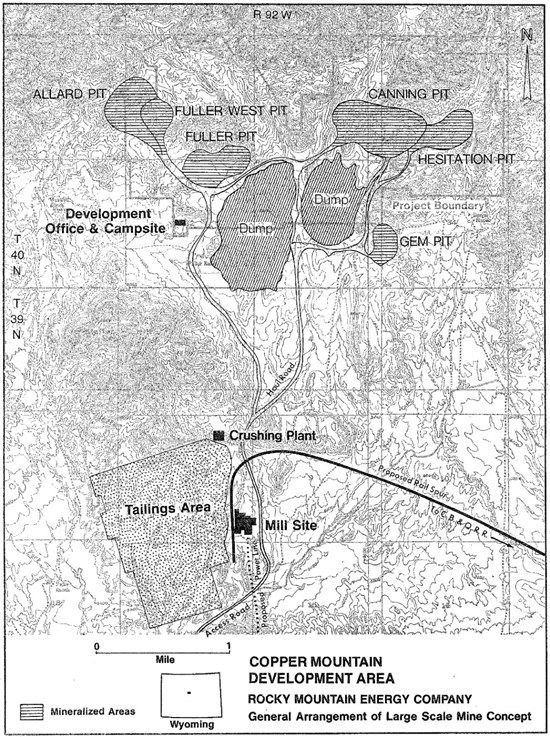

The Canning deposit area (Figure 1), which was the focus of confirmation drilling last season, is one of seven deposits identified by Union Pacific during the late 1970s via its subsidiary Rocky Mountain Energy Corporation ("RMEC"). Canning was to form part of a large-scale, conventional mining operation focused on supplying uranium to California Edison (Figure 2).

Figure 1. The Copper Mountain Uranium Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6301/269749_2d770d29e46ef8b9_002full.jpg

After drilling approx. 900,000 ft across 2,000 boreholes and spending US$85 million (2025 dollars), a decision was made by Union Pacific to upgrade the Copper Mountain Project from exploration to development status. An analog front-end (AFE) feasibility study determined the potential for conventional open pit mining feeding a centralised mill facility (heap leach) for processing.

A smaller, higher-grade deposit within Canning was also to be further assessed, but this work was cut short by the subsequent suspension of work at Copper Mountain following the decline in the global uranium market associated with Three Mile Island in 1979. At the time of this incident, at least fifteen other potential target areas across the broader Copper Mountain Project Area had been evaluated to some extent but not in sufficient detail to estimate maiden resources or exploration targets. However, most of these locations had some drilling undertaken or additional exploration work which underpinned the estimates of significant mineral endowment in the District by Union Pacific and Bendix Engineering for the U.S. Department of Energy. The Bendix estimates of Copper Mountain's uranium endowment are detailed in a recent news release which can be viewed here.

Figure 2. General Arrangement of Large Scale Mine Concept by Union Pacific (RMEC)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6301/269749_2d770d29e46ef8b9_003full.jpg

Issuance of Stock Options and RSUs

The Company also announces that it has granted an aggregate of 1,300,000 incentive stock options (the "Options") and an aggregate of 925,000 restricted share units ("RSUs") to certain of its directors, officers and consultants. Each Option vests immediately and is exercisable to acquire one common share of the Company at $0.43 for a period of five years from the date of grant. Each RSU is exchangeable for one common share of the Company and expire on December 31, 2028. The RSUs vest on the first, second and third anniversaries of the date of grant, subject to accelerated vesting in the event of: a change of control of the Company; the sale by the Company of a material asset of the Company (as determined by the Company's board of directors); or the closing price of the common shares of the Company on the Canadian Securities Exchange is $1.00 or greater at any time.

Certain directors and officers of the Company received Options and RSIS, and each such issuance is considered to be a "related party transaction" as defined under Multilateral Instrument 61-101 ("MI 61-101"). This is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as the fair market value of such issuances does not exceed 25% of the market capitalization of the Company, as determined in accordance with MI 61-101.

Notes to Disclosure of Historical Estimates - Copper Mountain, Wyoming

The following information is relevant to the disclosure of historical estimates referred to in this document (as per section 2.4 of the NI 43-101 Standards of Disclosure for Mineral Projects):

- The estimates completed by Fluor Mining and Metals Inc. (Fluor), May 20, 1980 are cited in several reports post-dating the estimate, including Howe (1997) and the most recent reference in a NI 43-101 Technical Report by Carter, G.S. (August 20, 2008) titled "Technical Report on the Uranium Resources at The Copper Mountain Project, Fremont County, Wyoming, U.S.A., on behalf of Neutron Energy Inc." issued by Broad Oak Associates. The estimates for the Gem deposit and past-producing Arrowhead uranium mine deposits were completed by Rocky Mountain Energy Corp. in 1977 and cited in report titled "Copper Mountain Exploration Project Report by Southard, G.G., Morton, D.K., Gordon. J.H. and Schledewitz, D.C., RMEC (December 1979).

- The historical estimates are based on data and reports prepared by previous operators. This included data from over 900,000 feet of hammer tool and core drilling. The descriptions of core drilling and core handling procedures, sample preparation and analysis, and procedures for statistical correlation of various assay methods are all presented in the reports and are considered appropriate. Based on the amount and quality of historic work completed, the information is considered relevant and reliable. This view is supported by earlier reviewers of the data and methodology, including David S. Robertson & Associates Inc. (1978) and Golder Associates (1979), who concluded that the core and sample handling techniques from the field through the sample preparation facility were in "accordance with good engineering practice". However, the resultant gamma logs and core assays that supported the estimations and associated technical work were not available to the Qualified Person, therefore a complete and thorough review of the data has not been possible.

- Earlier estimates by Rocky Mountain Energy Corp. (1977) used the polygonal estimation method based on ten-foot composite thicknesses and 0.010% U308 cut-off using gamma probe grades with a tonnage factor 12 cubic ft/ton. During an estimate update (most recent), Fluor (1980) investigated various resource estimation techniques. including polygonal methods, cross-sectional methods, ordinary kriging, and a method using conditional lognormal probability distributions, which was the chosen method. The key difference between the earlier RMEC estimates and those of Fluor was the use of core-equivalent Delayed Fission Neutron (DFN) grades using a correction formula derived from comparison between probe grades and DFN grades, that were accepted by RMEC as the most accurate determination of grade at the time.

- At the time of reporting, RMEC and Fluor used the U.S. Bureau of Mines resource categories, which were classified as follows: Measured Resources - projected one-half the distance toward the nearest control (i.e. another drill hole) or a maximum of 15 metres (50 feet), whichever occurred first. If correlateable mineral was not in the adjacent control or no adjacent control existed, a maximum of 7.5 metres (25 feet) of projection was allowed (a variance of 1.5 to 3.0 metres (5 to 10 feet) between controls above the maximum was excepted in a few cases). Indicated Resources - any mineral intercept at or above the cut-offs stated was considered to be at least of Indicated categorization. Isolated holes (i.e. those positioned greater than 30 metres (100 feet) from adjacent holes) were allowed a maximum projection of 7.5 metres (25 feet) to the center of the side of a square (a maximum area of influence = 25 ft. x 25 ft. or 625 square feet.). Between drill control, where correlations were feasible, but limits exceeded those for Measured categorization, Indicated Resources were extended and projected one-half of the remaining distance or 7.5 metres (25 feet) beyond Measured if correlation to adjacent control was not feasible. Inferred Resources - mineralization projected beyond the Measured and Indicated resource limits in areas bounded by surrounding drill control were categorized as Inferred. Grades and thicknesses of these areas were determined by averaging the intercepts from surrounding control. Inferred resources were projected to distances ranging from 7.5 to 365 metres (25 to 1200 feet). These categories, or the application thereof, are not necessarily compatible with current definitions. The "most likely mineable reserves" estimated by RMEC at the time would be categorized as Indicated and Inferred resources, in accordance with definitions of the CIM Definition Standards for Mineral Resources & Mineral Reserves (2014). The portions of the "reserves" (approximately 20 to 60%) that were drilled on 15 to 30 metre (50 to 100 foot) centres, and normally would be classified as Measured resources, are equated to Indicated resources, because of the nature of the mineralization, uncertainty regarding the grades and the lack of established economic viability of the deposits at the time. The remaining portions of the "reserves" drilled on 30 to 60 metre (100 to 200 foot) centers, are classified as Inferred resources. An attempt to separate the indicated from the inferred resources was not possible from the available information.

- There are no more recent estimates reported.

- In order to verify the historical resources and potentially re-state them as current resources, a program of digitization of data is required (to the extent possible), followed by re-logging and/or re-drilling to generate new data that is comparable with the original data that can be used to establish the correlation and continuity of geology and grades between boreholes with sufficient confidence to estimate mineral resources.

- A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves; and Myriad Uranium is not treating the historical estimate as current mineral resources or mineral reserves.

Qualified Person

The scientific or technical information in this news release respecting the Company's Copper Mountain Project has been reviewed and approved by George van der Walt, Pr.Sci.Nat., FGSSA, Myriad's consulting geologist and a Qualified Person as defined in National Instrument 43-101 — Standards of Disclosure for Mineral Projects. While the content of the reports is considered to be relevant and reliable, the underlying data, such as original drill logs, sampling, analytical and test data certificates, quality assurance and quality control, is not available for verification. Further work, such as drilling and sampling, will be required to verify or create supplementary information to support the underlying assumptions and conclusions.

About Myriad Uranium Corp.

Myriad Uranium Corp. is a uranium exploration company with an earnable 75% interest in the Copper Mountain Uranium Project in Wyoming, USA. Copper Mountain hosts several known uranium deposits and historic uranium mines, including the Arrowhead Mine which produced 500,000 lbs of U3O8. Copper Mountain saw extensive drilling and development by Union Pacific during the late 1970s including the development of a mine plan to fuel a planned fleet of California Edison reactors. Operations ceased in 1980 before mining could commence due to falling uranium prices. Approximately 2,000 boreholes have been drilled at Copper Mountain and the project area has significant exploration upside. Union Pacific is estimated to have spent C$117 million (2024 dollars) exploring and developing Copper Mountain, generating significant historical resource estimates which are detailed here. The Company also recently acquired, subject to completing a geophysical survey this year, a 100% interest in the Red Basin Uranium Project in New Mexico, which has extensive near-surface uranium mineralisation and significant upside potential. Our Crux Investor overview page including recent interviews can be viewed here. The Company's presentation can be viewed here. News releases regarding historical drilling can be viewed here and here. The final news release regarding chemical assays of 2024 Copper Mountain drilling can be viewed here. A press release discussing the 1982 U.S. Department of Energy assessment of Copper Mountain's uranium endowment can be viewed here.

For further information, please refer to Myriad's disclosure record on SEDAR+ (www.sedarplus.ca), contact Myriad by telephone at +1.604.418.2877, or refer to Myriad's website at www.myriaduranium.com.

Myriad Contacts:

Thomas Lamb

President and CEO

tlamb@myriaduranium.com

Forward-Looking Statements

This news release contains "forward-looking information" that is based on the Company's current expectations, estimates, forecasts and projections. This forward-looking information includes, among other things, the Company's business, plans, outlook and business strategy. The words "may", "would", "could", "should", "will", "likely", "expect," "anticipate," "intend", "estimate", "plan", "forecast", "project" and "believe" or other similar words and phrases are intended to identify forward-looking information. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect, including with respect to the Company's business plans respecting the exploration and development of the Company's mineral properties, the proposed work program on the Company's mineral properties and the potential and economic viability of the Company's mineral properties. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, but are not limited to: changes in economic conditions or financial markets; increases in costs; litigation; legislative, environmental and other judicial, regulatory, political and competitive developments; and technological or operational difficulties. This list is not exhaustive of the factors that may affect our forward-looking information. These and other factors should be considered carefully, and readers should not place undue reliance on such forward-looking information. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable law.

The CSE has not reviewed, approved or disapproved the contents of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269749